Advertisement|Remove ads.

VF Corp Stock Rises Ahead of Q3 Earnings But Retail’s Cautious

Shares of apparel company VF Corp ($VFC) have risen more than 7% in the past week ahead of the company’s third-quarter earnings, but retail sentiment has stayed cautious.

VF Corp is set to report third-quarter results on Jan 29 before the bell.

Wall Street analysts expect the company to post earnings per share of $0.34 on revenues of $2.75 billion, according to Stocktwits data.

VF Corp is expected to surpass its guidance, with flat to low single-digit year-over-year revenue growth at the higher end, Investing.com reported.

Earlier this week, TD Cowen reaffirmed a ‘Hold’ rating and bumped the price target to $25 from $24, based on its positive outlook for the company’s upcoming quarters.

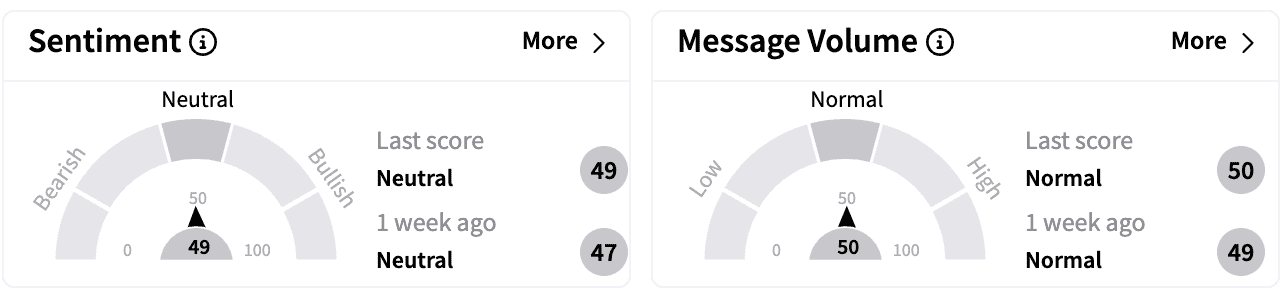

Sentiment on Stocktwits was ‘neutral’ compared to a week ago. Message volumes have continued to be in the normal range.

VF Corp recently said it would embark on additional layoffs as part of its previously announced

transformation plan, according to media reports.

“VF has begun a reorganization related to select commercial functions globally, intended to align these organizational structures to its new business model,” a spokesperson for VF told Fashion Dive.

VF Corp is a maker of apparel, footwear, and accessories in the outdoor, active, work segments. Its brands include The North Face, Vans, Kipling, Eastpak, and JanSport.

VF Corp stock is up 21% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)