Advertisement|Remove ads.

Why Did Rezolve AI Stock Surge 11% Today?

Rezolve AI (RZLV) announced on Wednesday that its annual recurring revenue (ARR) has surpassed $90 million year-to-date, prompting the management to raise its 2025 guidance to $150 million in ARR, up from the previous expectation of $100 million.

The company reported a 426% year-over-year (YoY) increase in revenue for H1 2025, reaching $6.3 million, which exceeded the $5.25 million forecasted by analysts, according to Fiscal AI data. Gross profit margin soared to 95.8%.

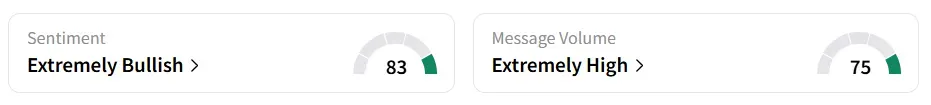

Following the announcement, Rezolve AI stock traded 11% higher on Wednesday morning and was the top-most trending equity ticker on Stocktwits. Retail sentiment around the stock shifted to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw a 135% increase in user message count over the past week. Stocktwits users sounded positive about the company.

The company now forecasts an ambitious $500 million ARR exit rate, driven by contracted recurring revenue. More than 100 global enterprises are now actively using Rezolve’s Brain Suite platform, which includes Brain Commerce and Brain Checkout.

“With our Brain Suite being Agentic Commerce ready and with the backing of partners like Microsoft and Google, we are at the forefront of the AI revolution,” said Founder and CEO, Daniel M. Wagner.

On Monday, short seller FuzzyPanda accused the company of overstating both its AI technology and its financial performance. It contended that Rezolve portrayed its AI solutions as more advanced than they truly are.

Rezolve AI stock has gained over 41% in 2025 and has lost over 18% in the last 12 months.

Also See: Plug Power Stock Rocketed 14% Today – Here’s What Happened

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)