Advertisement|Remove ads.

Exxon Mobil Shares Dip On Planned Production Cuts Ahead of Hurricane Francine, But Retail Remains Unfazed

Shares of Exxon Mobil Corp. (XOM) slipped 1.7% on Wednesday, and were on track for the second straight session of losses as the company braces for Hurricane Francine’s impact.

The oil giant reportedly plans to reduce production at its Baton Rouge refinery — one of the largest in the U.S.— to as low as 20% of its 522,500 barrel-per-day (bpd) capacity when the storm makes landfall.

Exxon’s decision to scale back operations comes as Francine is expected to pass just east of the refinery, which is the sixth largest in the country, according to Reuters.

Oil prices rebounded on Wednesday, with Brent crude futures climbing 1.55% to $70.26 a barrel and U.S. crude futures rising 1.83% to $66.95, driven by a drop in U.S. crude inventories and concerns over potential output disruptions due to the hurricane.

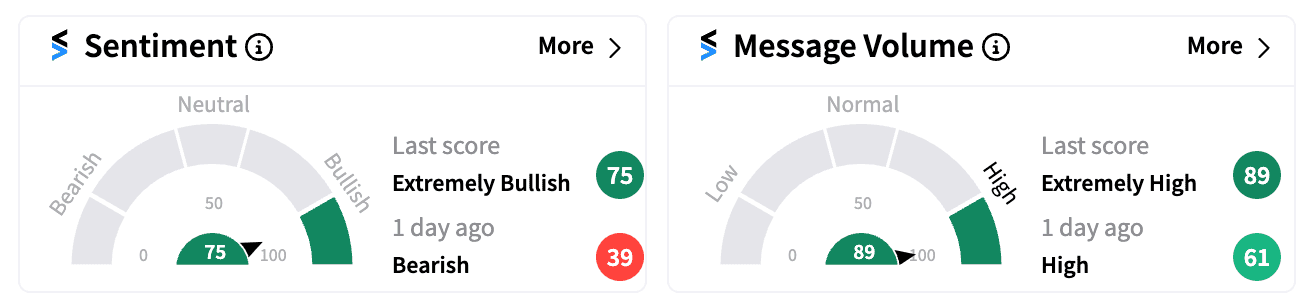

However, retail sentiment on Exxon flipped from ‘bearish’ to ‘extremely bullish’ (75/100) on Stocktwits as investors shrugged off the short-term production cuts.

One user expressed confidence in Exxon, posting, “$XOM bought the dip. Thanks.”

The stock has gained over 6% this year.

Exxon is also contending with broader challenges, including legal threats from activist investors and an ongoing arbitration battle with Chevron Corp. and Hess Corp. over a stake in its lucrative Guyana oil project.

Still, the company’s recent performance has been strong. Exxon in August posted its second-highest Q2 earnings in the last decade, buoyed by record production in Guyana and the Permian basin.

The recent merger with Pioneer is paying off, contributing $500 million to earnings in just the first two months post-closing.

Exxon’s aggressive share repurchase program also remains intact, with plans to repurchase $19 billion worth of shares in 2024.

Read next: Children’s Place Stock Skyrockets Over 60% On Surprise Profit, Retail Turns ‘Extremely Bullish’

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)