Advertisement|Remove ads.

Zim Integrated Shipping Earnings Top Wall Street Estimates, Upbeat Guidance Lifts Retail Sentiment

Zim Integrated Shipping Services (ZIM) is riding a wave of optimism, both on Wall Street and among retail investors, after exceeding expectations in its Q2 financial report, sending its stock price over 18% in pre-market trading on Monday.

Israel-based Zim comfortably beat analyst estimates on both earnings per share (EPS) and sales while it raised its full-year profit outlook.

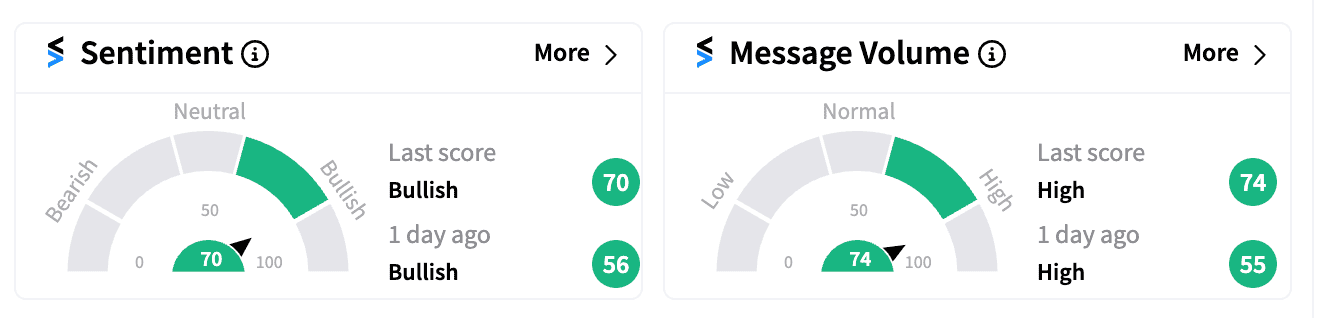

Retail investors on Stocktwits turned increasingly optimistic about Zim, with sentiment shifting deeper into the "bullish" (70/100), and message volume spiking significantly.

Some users even predict a potential rebound to the $30-mark and beyond in the future.

Contributing to the bullishness is Zim's revised guidance for adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), now expected to be in the range of $2.6 billion to $3 billion, compared with a prior estimate of $1.15 billion to $1.55 billion.

Additionally, the company announced a cash dividend of $0.93 per share, reflecting approximately 30% of its Q2 EPS.

CEO Eli Glickman attributed the company's success partly to its strategic increase in spot market exposure in the Transpacific trade. This allowed them to capitalize on elevated freight rates.

He also anticipates stronger performance in the second half of 2024 due to continued supply disruptions caused by the Red Sea crisis, coupled with favorable demand trends.

Missile and drone attacks in the Red Sea have forced many shipping companies to reroute vessels, impacting overall supply chains.

Zim's Q2 revenue rose to $1.93 billion from $1.31 billion a year ago, primarily driven by higher freight rates and increased cargo volume.

Carried volume rose by 11% year-over-year to 952 thousand twenty-foot equivalent units (TEUs), while the average freight rate per TEU jumped by 40% to $1,674.

Year-to-date, ZIM stock has gained an impressive 70%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)