Advertisement|Remove ads.

C3.ai Stock Plummets As Analysts Slash Price Targets Post Earnings: Retail Sentiment Sours

Shares of enterprise AI software maker C3.ai (AI) plunged as much as 16% on Thursday after several Wall Street analysts cut their price targets following the company’s latest earnings report.

At least six brokerages lowered their targets, with DA Davidson making the steepest reduction from $30 to $20, citing mixed results and ongoing challenges.

C3.ai’s Q1 results showed revenue growth accelerating for the sixth consecutive quarter, reaching $87.2 million, up 21% year-over-year and slightly beating analyst expectations of $86.9 million.

However, the company’s subscription revenue, a key metric, fell short at $73.5 million compared to the $79.1 million expected, casting a shadow over the earnings beat.

The company warned of continued pressure on gross and operating margins, driven by a higher mix of pilot programs that are costlier and increased investments in sales, R&D, and marketing.

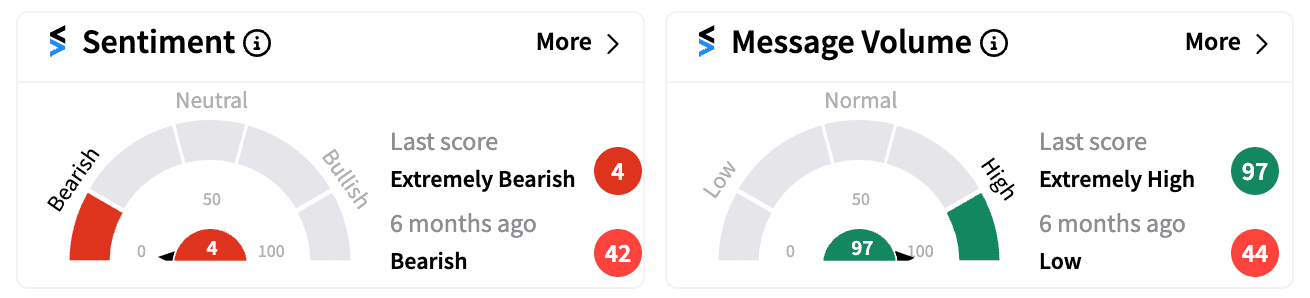

On Stocktwits, retail sentiment for C3.ai turned ‘extremely bearish’ (4/100), hitting its lowest level in a year, amid a surge in message volume.

Negative sentiment echoed across the platform, with one user describing C3.ai as the “Dollar General of AI,” predicting revenues to flatline revenues and losses to widen.

Analysts were also cautious in their assessments. Morgan Stanley’s Sanjit Singh lowered his price target to $21 from $23, citing underwhelming software revenue growth.

Similarly, Bank of America expressed skepticism, noting that C3.ai’s guidance "does not suggest that C3 is participating in tailwinds from the AI adoption cycle in a meaningful way.”

Still, some optimism remains. Oppenheimer recently highlighted C3.ai among its top picks for AI infrastructure and cloud migration, alongside Microsoft and Cloudflare, expecting enterprises to increase spending in these areas.

However, the broader market sentiment remains tepid, as C3.ai's stock has underperformed peers and major indices like the S&P 500 and Nasdaq, shedding nearly 20% this year.

With the company forecasting second-quarter revenue between $88.6 million and $93.6 million, and full-year revenue in the range of $370 million to $395 million, investors remain cautious about whether C3.ai can pivot effectively in a rapidly evolving AI landscape.

Read Next: Tesla Stock Extends Gains On Major FSD Update, Captures Retail Spotlight

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)