Advertisement|Remove ads.

Broadcom Stock Drops As Revenue Outlook Disappoints, But Retail Considers Buying the Dip

Shares of Broadcom Inc. (AVGO) dropped 9% pre-market on Friday, extending losses from the previous session after the chip designer reported quarterly earnings that beat expectations but issued a revenue outlook that fell short of analyst projections.

Broadcom reported third-quarter (Q3) revenue of $13.07 billion, slightly above estimates of $13.03 billion, and a profit of $1.24 per share, surpassing expectations of $1.22.

However, the company’s forecast for fiscal Q4 revenue of approximately $14 billion was below Wall Street’s consensus estimate of $14.1 billion.

There were concerns about slower growth in the company’s non-AI segments, which include mainframe products, security and data center software, mobile-phone chips, and data storage gear.

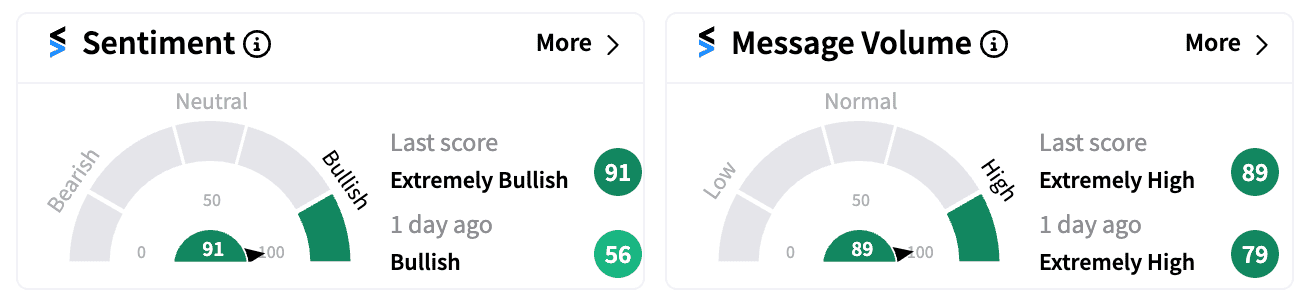

On Stocktwits, investor sentiment turned ‘extremely bullish’ (91/100) amid high message volumes, suggesting retail investors see this as a buying opportunity.

“I’m just happy to see it was a good quarter. Stock sell-offs happen. But longs don’t have anything to worry about,” wrote one bullish user.

While the revenue forecast disappointed Wall Street, many retail investors appear to be banking on Broadcom’s longer-term potential, particularly in AI, as a compelling reason to buy the dip.

CEO Hock Tan’s remarks helped bolster investor optimism. “We expect revenue from AI to be $12 billion for fiscal year 2024 driven by Ethernet networking and custom accelerators for AI data centers,” Tan said, adding that there had been progress with VMware integration.

He also highlighted that VMware is driving adjusted EBITDA margins to 64% of revenue as the company exits fiscal year 2024.

JPMorgan raised its price target on Broadcom to $210 from $200, maintaining an ‘Overweight’ rating, noting continued growth in Broadcom’s AI semiconductor segment and a cyclical recovery in its storage business.

Goldman Sachs raised its price target to $190 from $185, based on similar factors.

With the hyperscale capex environment expected to remain strong next year, UBS sees Broadcom’s AI revenue potentially growing another 35%-40% in the coming year.

Despite the recent slide, AVGO shares remain up more than 40% year-to-date, reflecting broader market enthusiasm for AI-related growth despite near-term revenue challenges.

Read Next: Applied Digital Stock Soars 70% On $160M Nvidia-Backed Funding, Makes Retail ‘Extremely Bullish’

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)