Advertisement|Remove ads.

GameStop Stock (GME) Heats Up On Stocktwits As Earnings Near: What’s Retail Feeling?

GameStop Corp. (GME) is capturing the maximum attention of retail investors on Stocktwits as the company prepares to release its second-quarter earnings report on Sept. 10.

Analysts anticipate a loss per share of $0.90 and revenue of $895.67 million for the quarter.

This follows a volatile year for GameStop, with its stock price rising over 40% despite missing earnings expectations in Q1 and failing to attract the same level of retail investor frenzy that made it a phenomenon in 2021.

The return of "Roaring Kitty" influencer Keith Gill earlier this year sparked some hope for a repeat of the meme-stock craze. However, retail investor participation, as evidenced by "odd lot" data, hasn't reached the record levels seen in 2021, according to Bloomberg.

The upcoming earnings call follows a rocky few months for the company. In June, GameStop surprised investors with an early release of its Q1 earnings, revealing slowing sales and a larger-than-expected loss.

Compounding this, the company announced plans to issue up to 75 million additional shares, which briefly dampened investor sentiment and sent the stock lower.

In an effort to reassure investors, CEO Ryan Cohen later outlined plans to operate a smaller network of stores, though specifics about future strategy and use of cash reserves remain vague.

“Revenue without profits and prospects of future cash flow are of no value to shareholders,” Cohen bluntly stated at the company’s annual shareholder meeting.

While GameStop faces its own set of challenges, the broader gaming market has shown signs of resilience. According to Circana analyst Mat Piscatella, U.S. spending on video game hardware, content, and accessories jumped 10% in July 2024, reaching $4.8 billion.

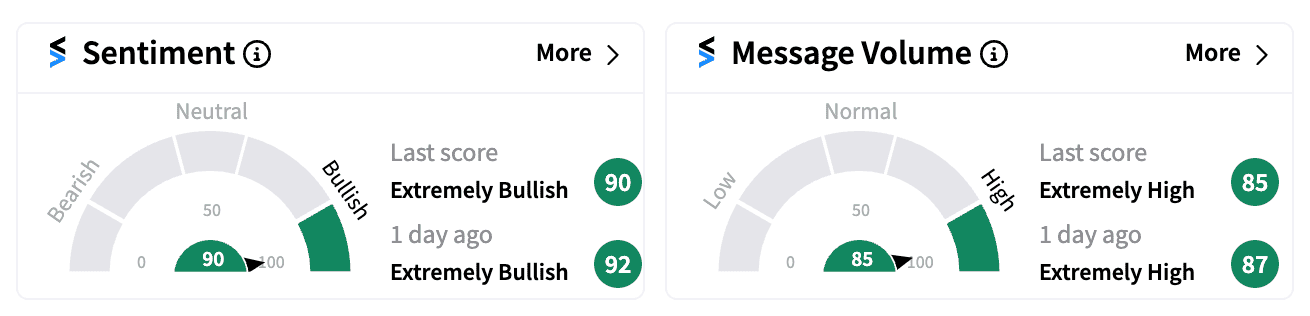

On Stocktwits, GameStop’s nearly 300,000 followers remain ‘extremely bullish’ (90/100) on the stock, with high message participation driving up the conversation.

One optimistic user wrote, “$GME who is ready to see over 30 this week?”

Another trader highlighted GameStop’s strong cash position, zero debt, and loyal shareholder base.

Read Next: Why Micro-cap WTO Stock's Retail Following Surged By Nearly 45% This Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)