Advertisement|Remove ads.

Rivian Stock Dips After Morgan Stanley Downgrade: Retail Sentiment Slumps Too

Shares of Rivian Automotive, Inc. (RIVN) fell over 2% in pre-market trading Wednesday, following a downgrade by Morgan Stanley.

Analyst Adam Jonas downgraded the stock from ‘Overweight’ to ‘Equal Weight’ and lowered the price target to $13 from $16.

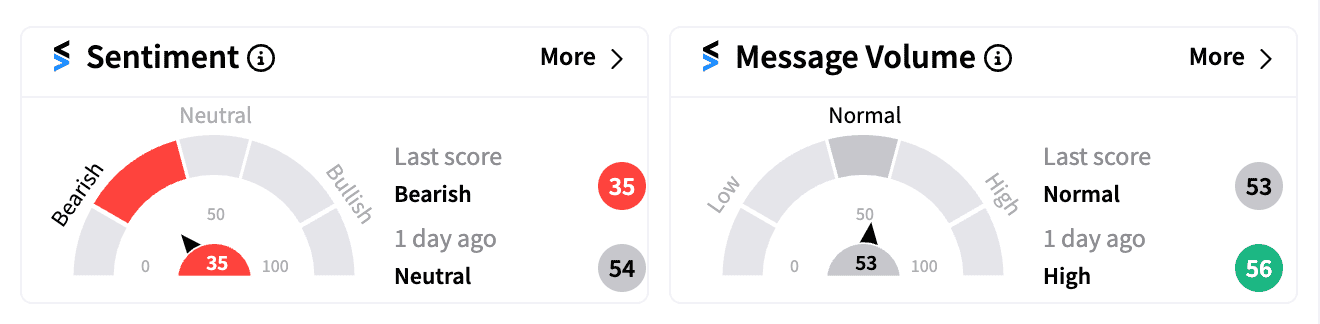

Rivian was also the top trending ticker on Stocktwits by 7 a.m. ET, with retail sentiment dropping to a ‘bearish’ (35/100) score, down from ‘neutral’ a day earlier.

Jonas cited concerns over Rivian’s ability to scale its electric vehicle (EV) production competitively.

The analyst highlighted Rivian’s planned capital expenditures (capex) of $1.3 billion and research and development (R&D) spending of $1.7 billion in 2024 were significantly lower than Tesla’s — whose CEO Elon Musk sees $10 billion AI-related spending this year.

Morgan Stanley questioned whether Rivian investors are “ready to support a new computing capex cycle.”

Rivian has been upgrading its vehicle line-up, incorporating Nvidia chips into its next-generation R1 models to enhance performance, range, and computing power. Prices for these vehicles range from $69,900 to over $106,000 for top-end trims.

Morgan Stanley also expressed concerns about rising U.S. auto inventories, unaffordable vehicles for many households, and increasing delinquencies for “less-than-prime” consumers, all of which could weigh on Rivian’s performance.

Rivian's stock is down over 40% year-to-date, as it continues to face production issues and softening demand.

Despite the negative outlook, some investors remain hopeful due to Rivian’s partnership with Amazon — its largest investor with an order for 100,000 electric delivery vans by 2030 — and a potential cash infusion from a $5 billion deal with Volkswagen.

Rivian’s next generation R2 SUV, set for release in 2026, could help the company attract a broader consumer base, with a starting price of $45,000.

But for now, retail investors appear increasingly cautious as Rivian navigates a tough environment.

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258302119_jpg_de7ca8145a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_resized_jpg_2bea8659fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204450056_jpg_cf352d689b.webp)