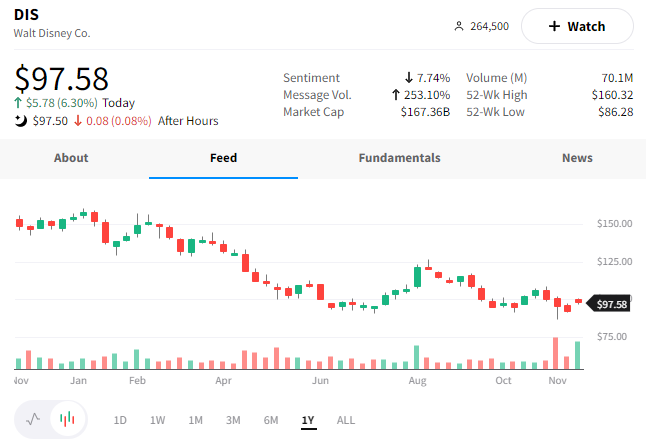

A stock price falling nearly 60% over the last eighteen months left many investors wondering what could turn things around at the company. 🤔

Well, in a late-Sunday announcement, Disney informed the world that Bob Iger is back as Chief Executive Officer (CEO). Just eleven months after leaving, he’ll replace his hand-picked successor, Bob Chapek, who has faced much scrutiny over his company management.

Reports are that Kareem Daniel, Disney’s head of media and Chapek’s right hand, is also being pushed out. 👋

Disney+ has been a major growth driver for the company, but it came with many increased costs. That, combined with other business segments like parks missing analyst expectations, had investors concerned that the company was headed down the wrong path. There were also concerns that Chapek’s management style did not jive with Disney’s family-friendly culture.

Overall, investors appeared thrilled that “Bob the Builder” Iger was back to right the ship. $DIS shares rose 6.30% today. 👍