The primary bull case for Tesla is that it’s not an automobile company but a technology one. Part of the reason it’s able to command such a high valuation relative to its peers is because of that technology’s potential business impact way down the line, especially as it introduces newer developments like artificial intelligence (AI).

However, that bull case is facing an unlikely opposition…from Elon Musk himself. 🤦

The Tesla CEO took to his social network X to say, “I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned. Unless that is the case, I would prefer to build products outside of Tesla.”

In other words, he wants the Board of Directors and other investors to award him additional ownership. And if they don’t comply, he’ll simply build his future ideas outside of Tesla and put the company’s ambitious goals at risk.

Now, we’re no experts. But that certainly sounds a bit like a thinly veiled threat coming from the CEO and largest shareholder of the company. 😮

Critics had a lot to say about the situation, the first being that Musk sold $40 billion of Tesla stock to buy Twitter. He made a bad deal and now wants Tesla shareholders to pay the price for it. Besides the direct financial impact, they also suggest Musk’s split attention and focus has impacted Tesla’s ability to execute its longer-term plans. 💸

The second objection is that he’s pressuring Tesla’s board for additional compensation at an inopportune time. The company’s recent earnings reports have shown slowing growth and profitability as the electric vehicle industry grapples with several major headwinds.

And on top of that, the company is still waiting for a Delaware Chancery Court ruling on a shareholder lawsuit over Musk’s $55 billion performance award in 2018. Until that case is resolved, the company is unable to offer Musk another compensation plan. 🚫

It’s unclear what exactly Musk is looking to accomplish with this approach. If anything, this adds more uncertainty to the company’s (and Musk’s) trajectory. But as always, we’ll have to wait and see if he’s playing chess while the rest of us play checkers. ♔

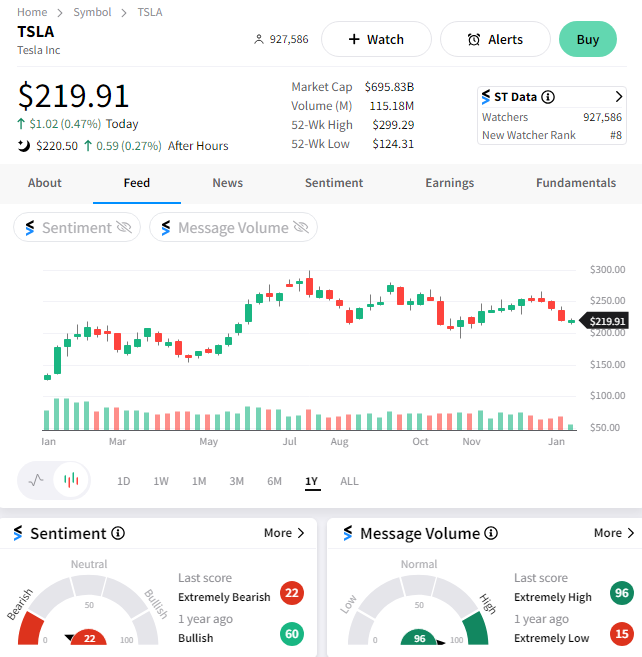

$TSLA shares were marginally positive on the day as investors digested the news. The stock has struggled so far in 2024, with the Stocktwits’ stream most recently leaning bearish. 🐻