The problems at Walgreens Boots Alliance continue, with the pharmacy chain’s investors’ biggest fear coming true today. 😱

Starting with the positives, second-quarter adjusted earnings per share of $0.66 and revenues of $36.70 billion topped expectations of $0.62 and $34.90 billion. While earnings were about half what they were last year, investors were happy to see some progress in earnings stabilizing in a challenging environment. 🔺

However, the positives were insufficient to offset the board slashing the quarterly dividend from $0.48 to $0.25. The company had paid a consistent dividend for the last 91 years, but a rapidly falling stock price caused its dividend yield to balloon above 7.5% before the cut was announced. ❌

Executives reiterated that this decision was difficult but necessary for the company’s long-term health. They continue to look for ways to drive sales growth and cut costs, exploring various options, including spinning off its “Boots” division.

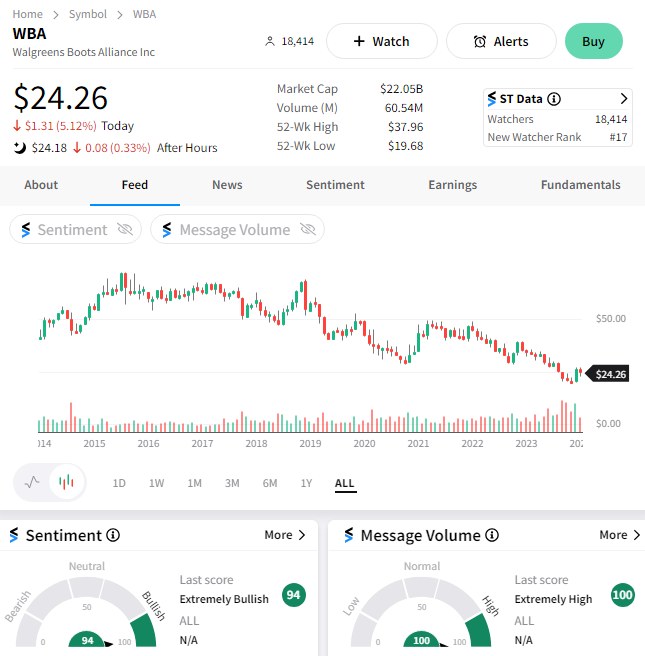

$WBA shares swung sharply from positive to negative in pre-market trading, ultimately regaining some of the decline during regular hours to close down 5.12%. 📉

Without a significant dividend giving investors a reason to hang on through the turnaround, many market participants are taking their lumps and looking for other opportunities. A mature company with a slashed dividend and weak revenue/earnings growth is not exactly courting many types of investors. So we’ll have to wait and see who’s interested in buying the dip. 🤷

There’s also been significant speculation about whether the company will be booted from the Dow Jones Industrial Average over its poor performance, though that’s unsubstantiated for now. 🤫