Those who work at AT&T today did not have a great day, but those who use their services had a pretty good excuse to chill out at work today. That’s because the telecom giant experienced a nationwide cellphone outage that impacted tens of thousands of its customers today. 📵

While the nation’s largest carrier said it restored wireless service to all impacted customers by midday, no reason has been given for the outages. With T-Mobile and Verizon’s networks unaffected, regulators quickly questioned whether AT&T experienced a hack or other cyberattack. 📡

Despite that suspicion, U.S. cyber officials tracking the outage said there’s no indication of malicious cyber activity so far. As a result, regulators, customers, investors, and other stakeholders are left to wonder how this could happen and worry that it might happen again.

It’s been a rough few years for telecom stocks, with this event adding to a slew of bad news impacting the companies and their stocks. 📰

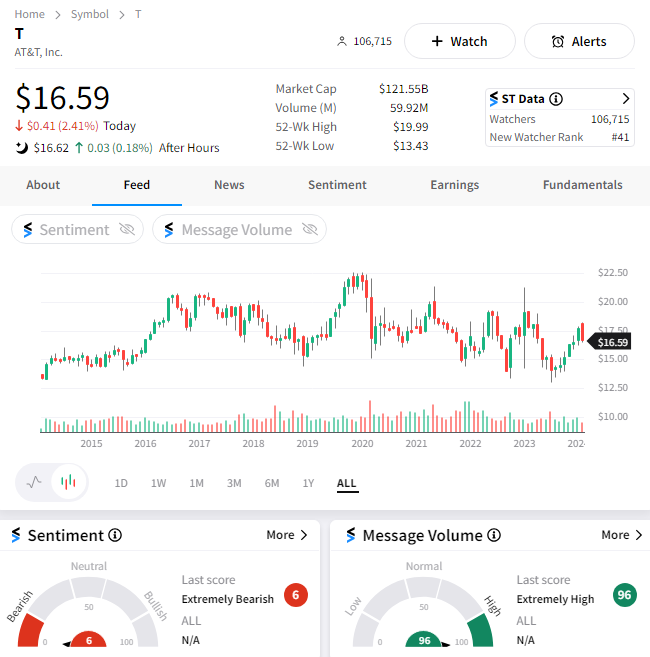

AT&T shares fell roughly 3% on the day, but the Stocktwits community is not looking to bottom-fish the troubled stock. Sentiment is currently in “extremely bearish” territory as investors look elsewhere for opportunity. 👎