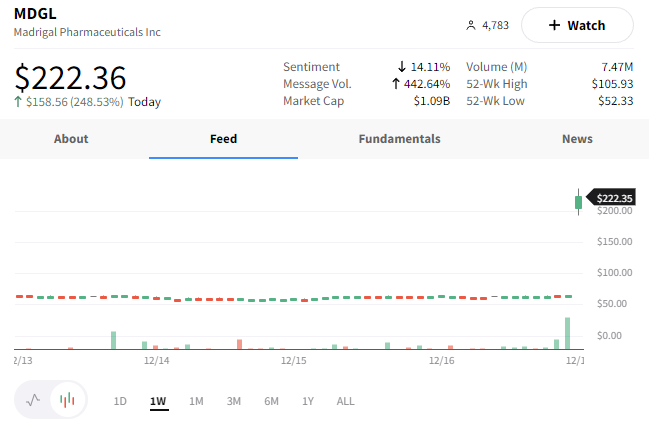

Argentina isn’t the only team that’s scored big lately. $MDGL pulled off a hat trick by more than tripling in pre-market and continuing to drive higher throughout the day. 🚀

Analysts attribute today’s massive price spike to the test results of a treatment for nonalcoholic steatohepatitis – NASH. NASH is a progressive disease that causes fibrosis – inflammation of the liver.

The test was completed with 950 NASH diagnoses patients. After one year, 30% of patients on the highest dose saw a two-point (out of eight total points) improvement in their symptoms. Additionally, their fibrosis did not become worse.

In another 26% of patients, at least one stage (out of five stages of fibrosis) improved with no increase in their symptoms.

Madrigal is requesting FDA approval for its oral treatment (pill), Resmetirom.

After years of failures to find treatment for this disease, Madrigal’s would be the first to hit the market. 💉