The U.S. “degenerate economy” is getting its latest entrant, with FanDuel parent company Flutter Entertainment making its debut on the New York Stock Exchange (NYSE) today. 🤩

With that said, the company did not receive the traditional fanfare it would in a standard initial public offering (IPO). That’s because it was listed on the London Stock Exchange (LSE) in May 2019, and its American depository receipts (ADR) have traded over the counter under the ticker $PDYPY for years.

However, this secondary listing on the NYSE is the first step in the company’s seeking shareholder approval to make the U.S. exchange its primary listing. While the company says it makes sense because the U.S. is its biggest customer market, others have pointed out that the London Stock Exchange has recently lost its luster with many companies. 👎

The exchange has been plagued with depressed valuations, especially since Brexit, as investor appetite shifted elsewhere. So, with U.S. exchanges and investors able to offer better fundraising potential, we’re seeing more and more companies turn to U.S. markets.

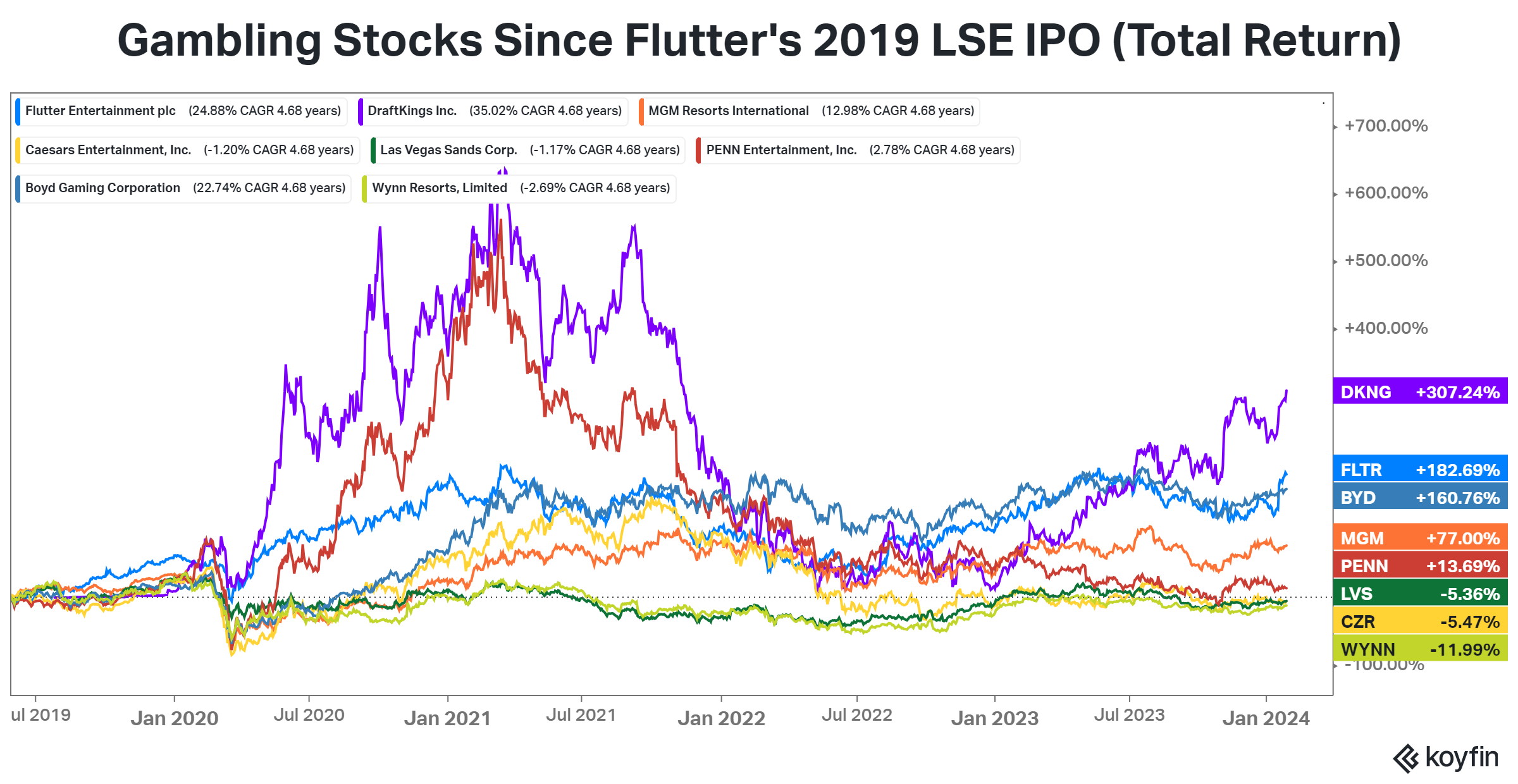

Although $FLUT shares were essentially unchanged in their debut, it’s important to note that Flutter has been one of the better-performing stocks in the industry since going public almost five years ago. Whether or not that will continue remains to be seen, but the company has caught investors’ attention before a bet-heavy Super Bowl Sunday. 💸