Three weeks ago, we spoke about AMC’s shareholder vote, where roughly 90% voted in favor of two proposed actions. 👍

- Converting existing APE units into AMC shares

- Performing a 1:10 reverse split of AMC common shares

In that article, we noted that were was still some legal overhang. A group of shareholders had sued the company, claiming management used the APE units to circumvent the will of investors who were afraid of further dilution. And while that lawsuit was scheduled for trial on April 27th, a settlement was announced today. 🤝

Although details of the settlement were not disclosed, it paves the way for the company to carry out the plans shareholders approved last month. It now just needs to ask the court to lift the order preventing it from doing so. 📝

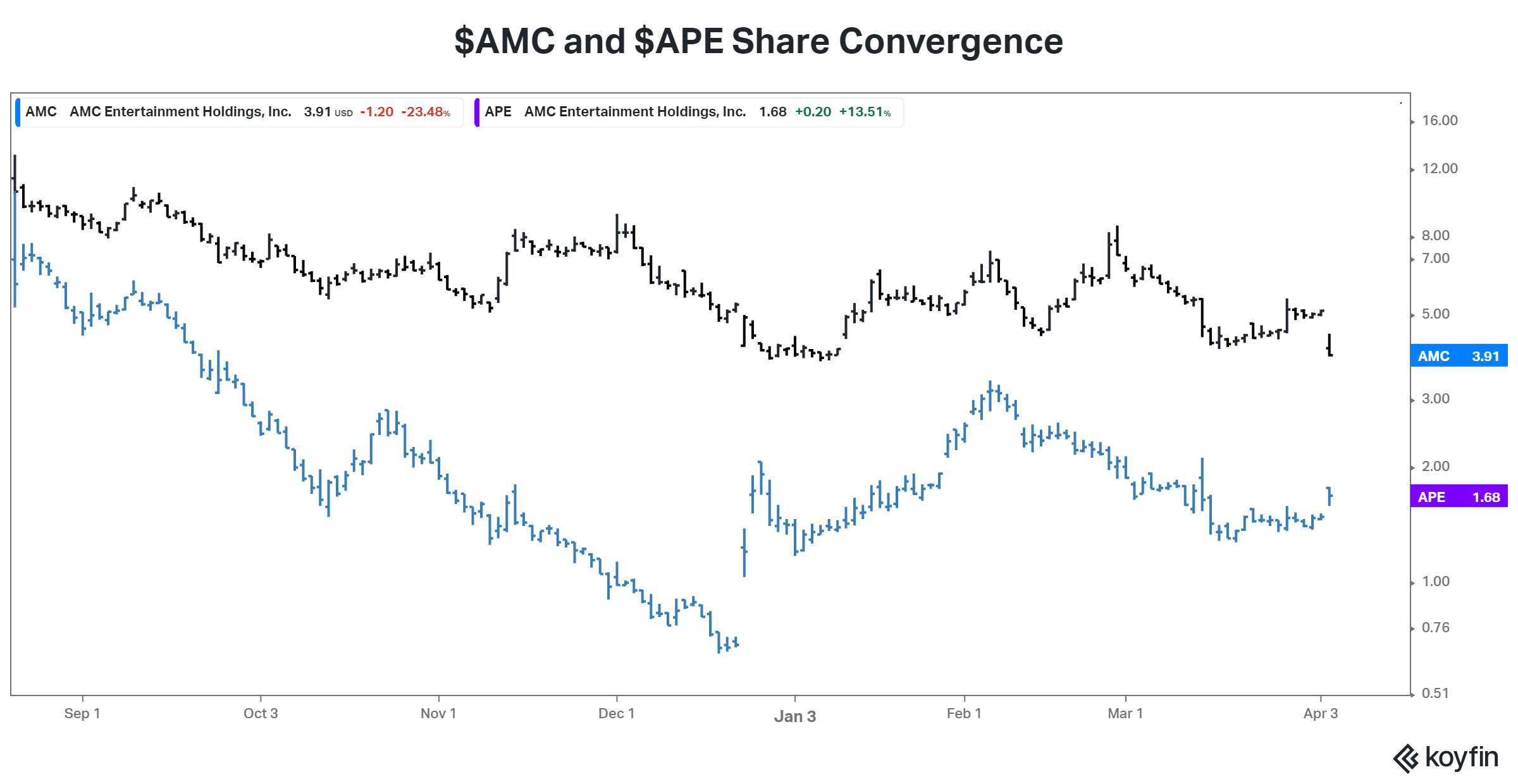

If the market believes this path forward is the most likely one, then shares of $AMC and $APE should start to converge. And that’s precisely what we saw happening in the market today. The company’s common shares fell nearly 24%, while its APE units rose 14%. 👇

As for what this mean’s for the company’s future, nobody knows exactly. On the one hand, this news means the company can raise cash to pay down its debt by issuing more equity. On the other, it means more dilution for existing shareholders.

As a result, shares will likely remain volatile as investors assess the movie-theatre chain’s future. 🤔