With the upcoming presidential election looming, the current administration is itching to accomplish more before a potential shakeup. While antitrust regulators have had a field day with big tech, airlines, grocery chains, and others this year, they’re taking another look at UnitedHealth, especially given its recent cybersecurity issues. 🕵️♂️

The Justice Department is poking around to figure out the relationship between the company’s UnitedHealthcare insurance unit and its Optum health-services division. They’ve asked how UnitedHealth’s acquisitions of doctor groups might affect competitors and consumers. 🤔

With UnitedHealth being the dominant U.S. health insurer in commercial markets, this isn’t the first time regulators have scrutinized the company. The Justice Department sued to block its acquisition of Change Healthcare Inc. in 2022 but ultimately failed in court.

However, it’s still investigating the company’s planned acquisition of home-health company Amedsiys, among other relationships.

Given the recent aggressive nature of antitrust regulators, further scrutiny of UnitedHealth makes investors feel a bit uneasy. $UNH shares had already been under pressure because rising medical costs were hurting margins, so this added another layer of risk to the stock. ⚠️

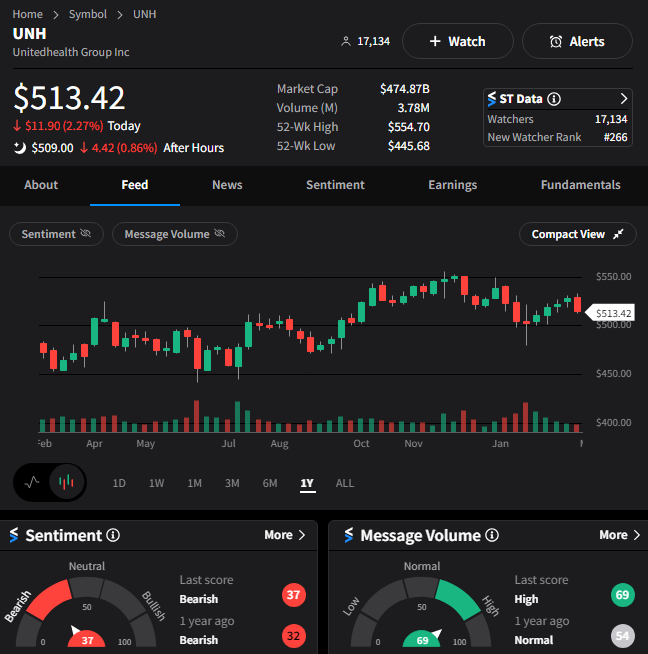

As the image below shows, the Stocktwits community is currently negative on the stock. We’ll have to see if their negative approach continues to pay dividends. 🐻