The wild ride for AMC Entertainment shareholders continues following Friday’s court ruling, allowing an earlier settlement to proceed. 🧑⚖️

As a refresher, some AMC shareholders sued the company over its issuance of $APE units. They claimed that executives circumvented the will of shareholders by issuing preferred shares after losing a vote to issue more common shares of stock.

Roughly three weeks ago, a judge struck down the proposed settlement saying it didn’t represent claims by preferred shareholders not present in the lawsuit. However, today the company received approval to make a settlement payment of one Class A common stock for every 7.5 Class A shares to the entitled shareholders. 👍

That payment will occur after its 10-for-1 reverse stock split on August 24 and its preferred $APE units conversion into common shares on August 25.

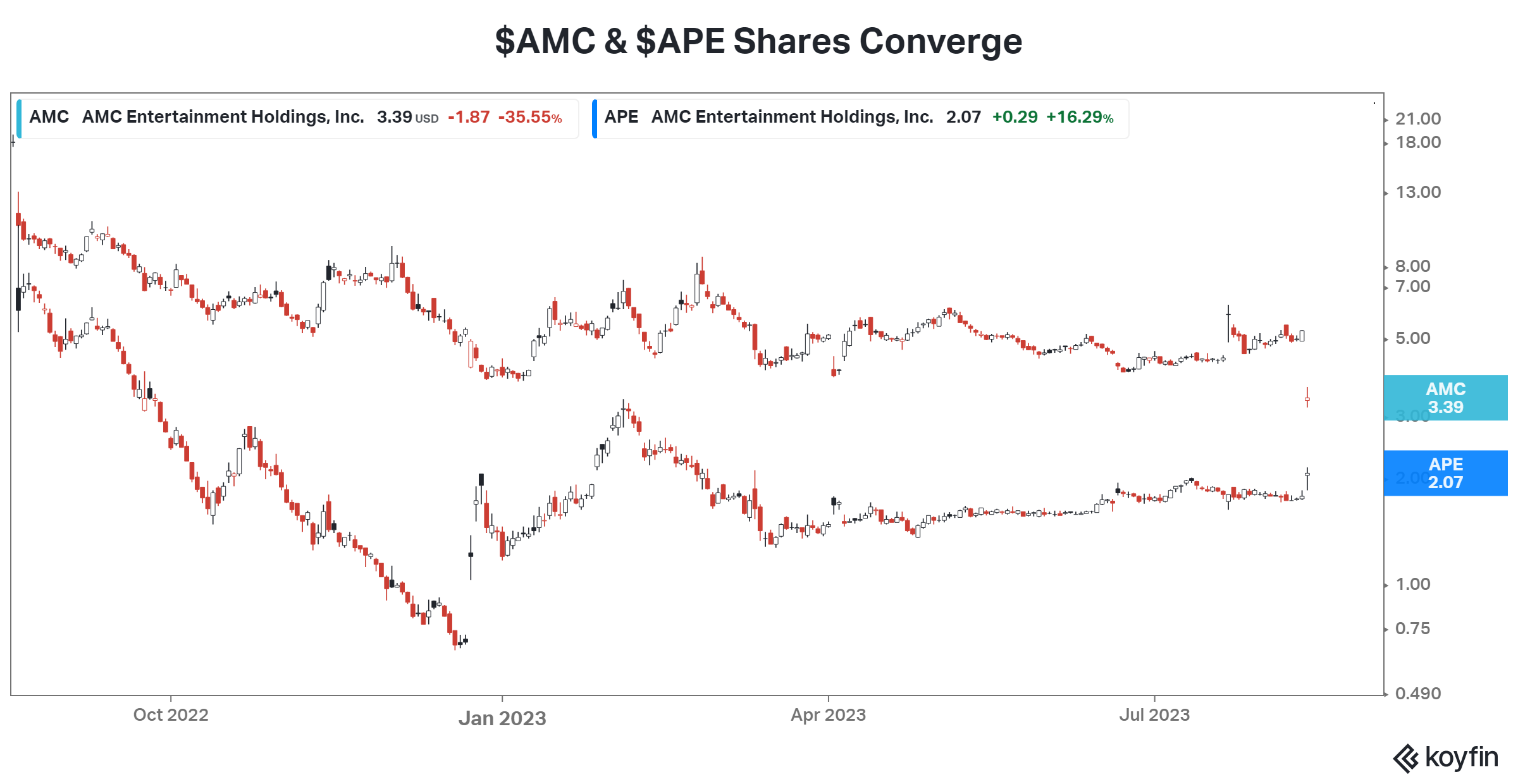

The news sent $APE shares soaring and $AMC shares plummeting because it ultimately means more dilution ahead for common shareholders. While this is a short-term negative, executives say it is necessary for the business to turn itself around over the long term. They’ve long warned the market that it would be at risk of going out of business without the ability to raise more equity capital. ⚠️

Time will tell if shareholders are willing to stick with the company through tough times. But now, with this plan closer to officially moving forward, the market is adjusting to the new reality. Many traders expect these two share classes to continue converging in price until the split and conversion occur. 📈📉