It’s been a rough ride for pharmaceutical giant Pfizer since the end of the pandemic, and that rollercoaster ride continues today. 🎢

The company last announced earnings in October but needed to update Wall Street on its 2024 forecast. It cited weak demand for its Covid products as the reason for a weaker-than-anticipated revenue and earnings forecast.

The company now expects $58.50 to $61.50 billion in revenues, implying essentially zero YoY growth and coming in below the $63.17 billion consensus estimate. As for earnings, it provided a range of $2.05 to $2.25 per share, well below the adjusted profit of $3.16 that analysts expected. 🔻

Since it’s unable to drive revenue growth, management is turning to additional cost-cutting to drive results. It now anticipates $4 billion in savings from its plan, up $500 million from its last estimate.

Pfizer CFO Dave Denton said, “While we do not expect Covid vaccination and infection rates to change materially in 2024 versus this year, we have set our Comirnaty and Paxlovid 2024 revenue expectations lower.”

The company looks to be setting the bar low for next year to give itself a chance to jump over it easily.

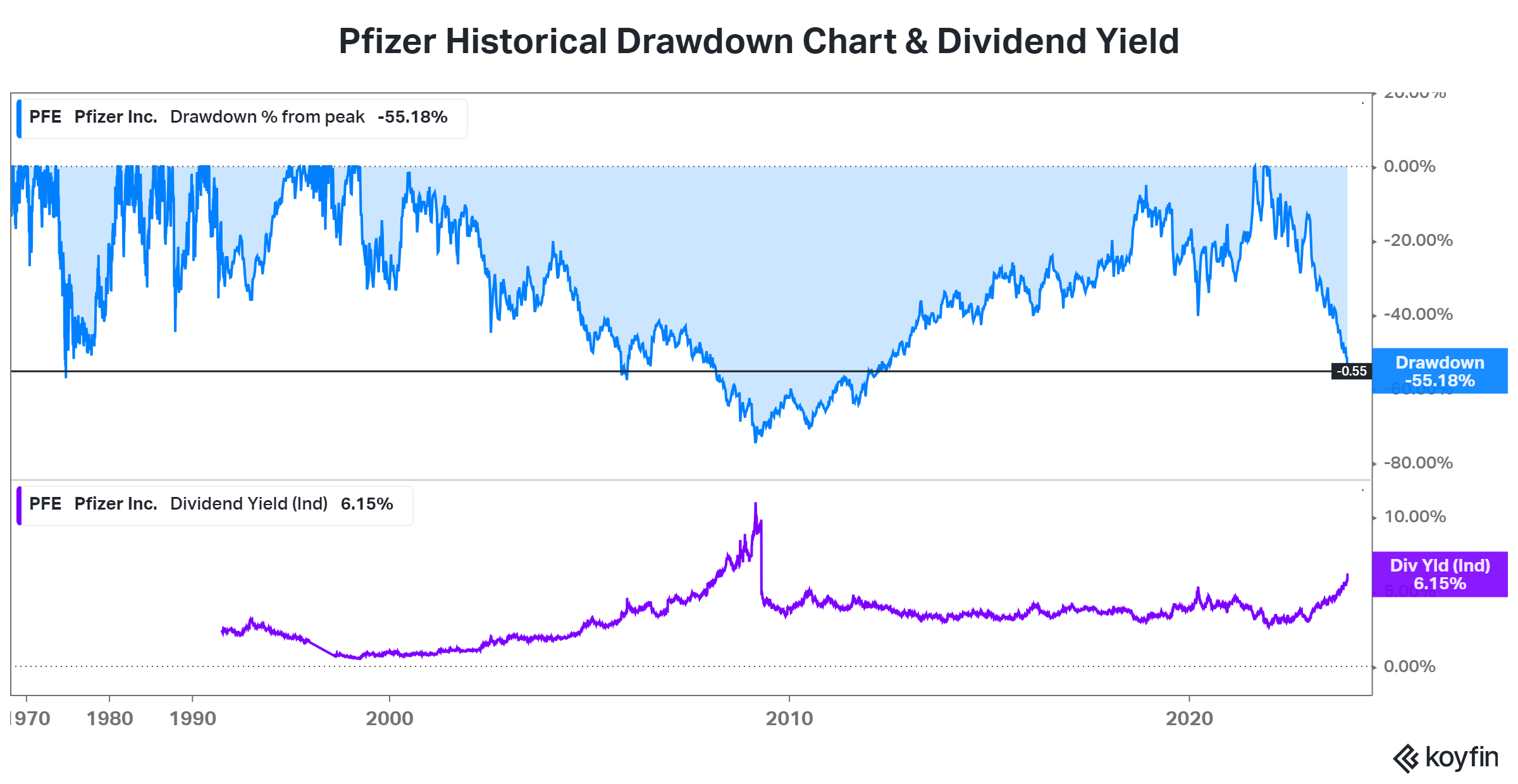

However, the short-term impact is that the stock extended its historic drawdown from all-time highs to 55%. This decline matches one of the largest in history, only meaningfully surpassed by the great financial crisis. Its dividend yield is now also the highest in years, though some investors fear it may have to be cut. 😱

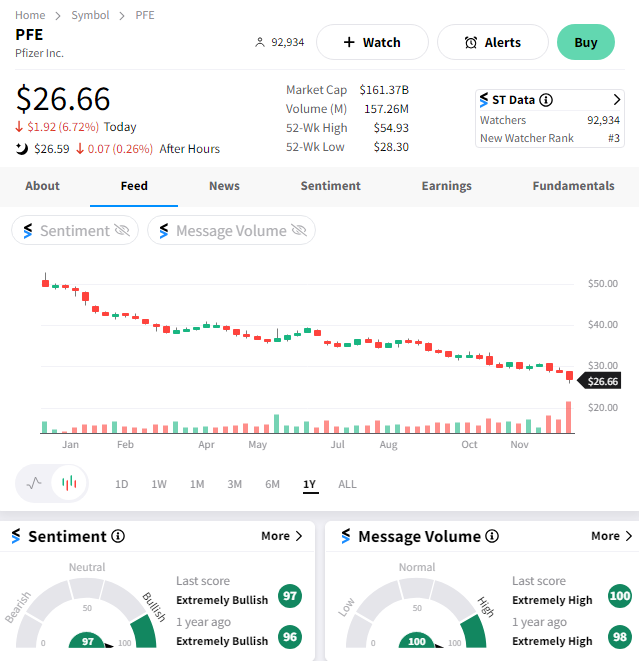

As for the price chart, $PFE shares fell another 7% on the day despite the broader market being up handily. Despite prices being in a sustained downtrend for well over a year, the Stocktwits community remains bullish on the stock. We’ll have to wait and see whether their bet pays off. 🤷