It’s been a while since U.S. Steel has been in the news. But today, it’s making headlines after receiving multiple surprise offers over the weekend and beginning to explore strategic options. 📝

Initially, the nation’s second-largest steelmaker Cleveland-Cliffs proposed buying the company at $32.53 per share. The roughly half cash and half stock deal would have made the combined company the largest steelmaker ahead of Nucor.

Talks were originally private but broke down last week after Cliffs failed to sign a nondisclosure agreement that would allow the two companies to exchange financial information safely. 👎

Late in the day, Esmark jumped into the bidding war, announcing an all-cash offer for U.S. Steel of $35 per share. Its offer is valid through November 30, 2023, but may be extended. 💰

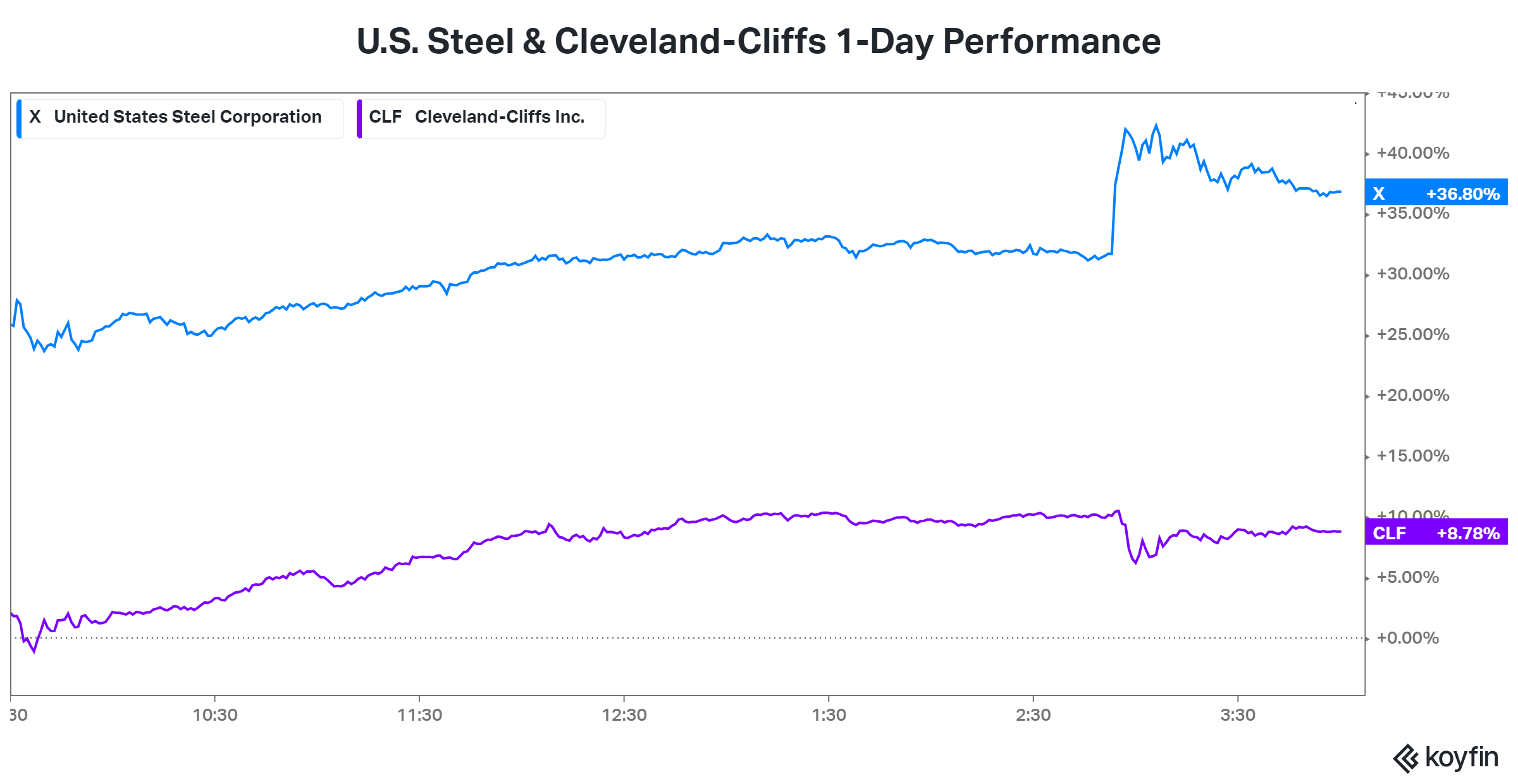

News of that competing offer sent U.S. Steel shares jumping again, with Cleveland-Cliffs shares dipping. Both $X and $CLF shares will likely remain volatile as it assesses the proposals and explores the best path forward for its shareholders. But for the first time in years, steel is sexy again. 🤩