Seemingly everyone from global conglomerates to content creators is getting in on the beverage space. That’s because beverage products tend to have much higher margins than food products. And if you can market your way through the competitive space, you can make a pretty penny. 🧃

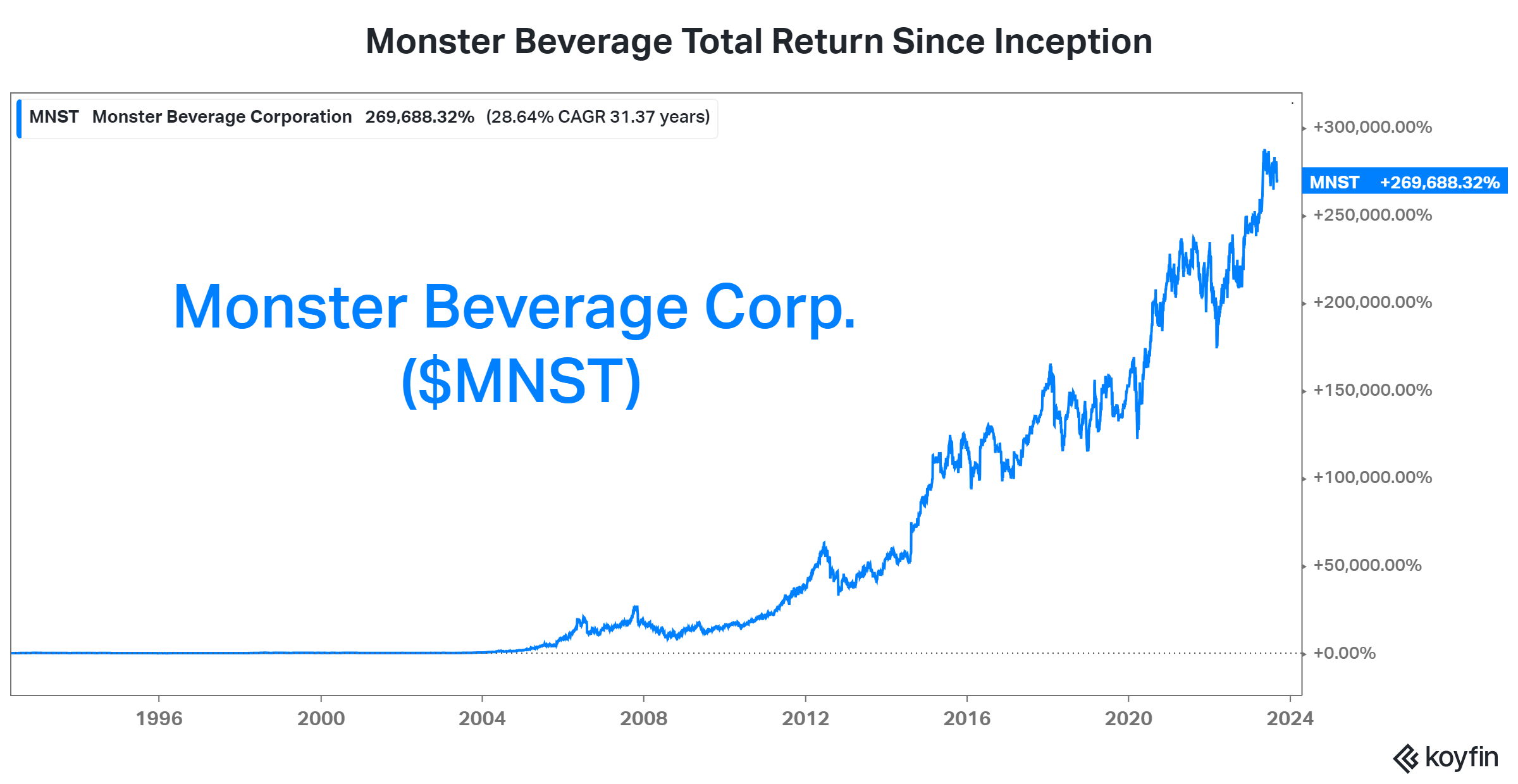

If you need evidence of that, just look at one of the best-performing stocks in the market, Monster Beverage. Since going public about thirty years ago, it has returned nearly 270,000%. It’s almost as if its stock price drank a lot of monster energy. 🤩

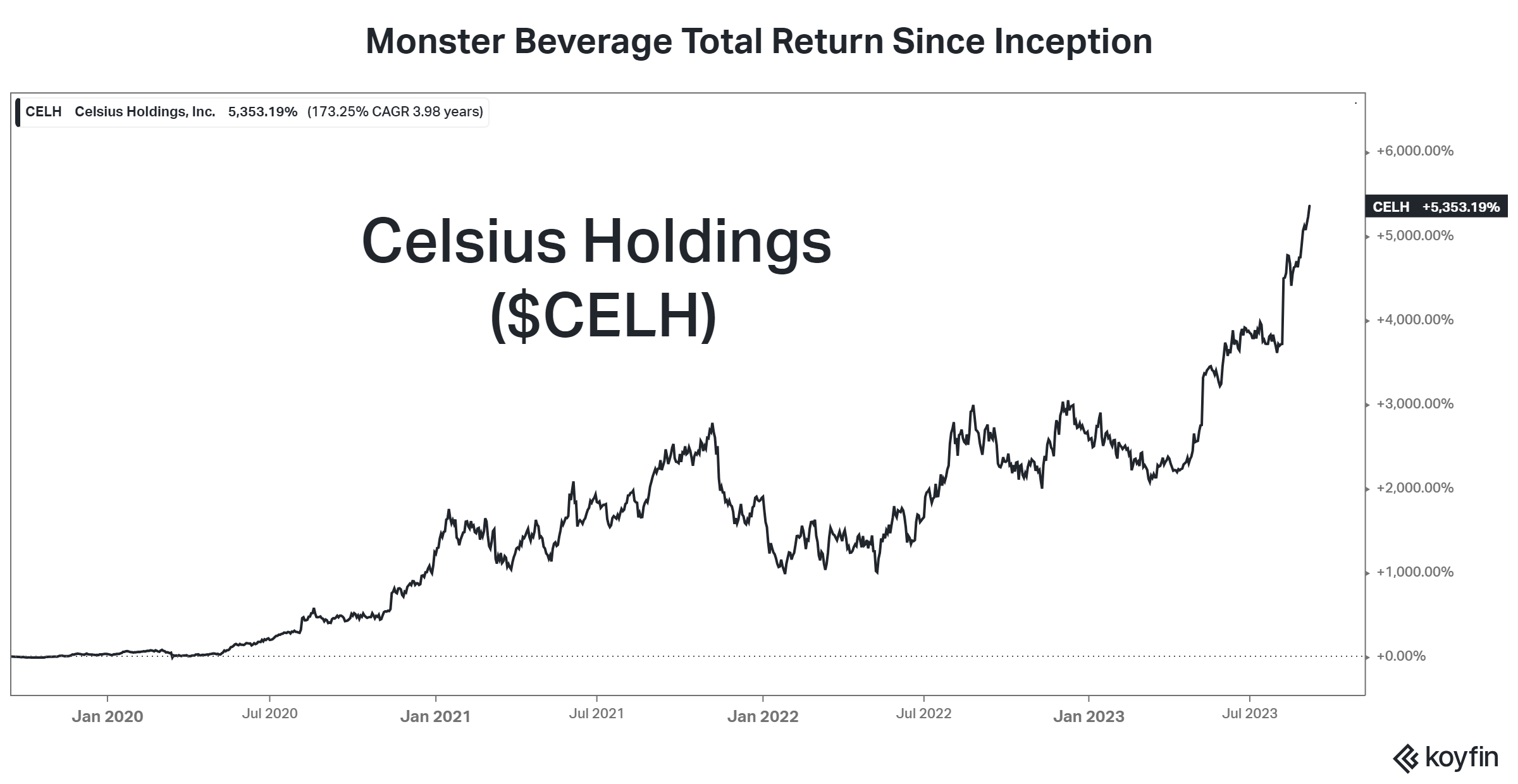

Or check out Celsius Holdings continuing the epic run that began when it went public. 🗓️

Or the many creator or celebrity-driven drink brands like Logan Paul’s Prime and Ryan Reynolds’ Aviation Gin. The point is that the beverage space can be a very profitable one. 🍸

And with pricing power on its current products diminishing, Pepsi is looking to beverages to help drive growth. Its newest idea is an expansion to the Gatorade brand, with a new “Gatorade Water.” It’ll launch early next year as an electrolyte-infused, unflavored water product that’s filtered with a seven-step inflation process and contains alkaline and enhanced pH levels. 🌊

The company says roughly 30 million consumers do not buy enhanced water at all. But it’s making the bet that the primary reason is because it’s not from a brand they know and trust. Thus, offering the product under the Gatorade name and packaging could pull new customers into the market.

The brand remains the recovery drink category leader, but Gatorade sales haven’t experienced as strong growth as some competitors. That led to the company expanding its portfolio into energy beverages, protein powders, capsules, and more aimed at those looking to improve their health.

We’ll have to wait and see if this bet pays off. But with the popularity of water brands like “Liquid Death,” anything is possible. 🤷