Unlike the excitement over the pizza at Casey’s General Store, Apple’s annual iPhone launch event was an absolute snoozefest. 😴

Investors had been looking for exciting changes to the product to help justify higher-priced phones or at least entice customers to upgrade; they were left disappointed. That’s because the iPhone 15 price was not raised and will again start at $799 for the base model and $999 for the pro model. The only model to see a change was the Pro Max, which will start $100 higher at $1,199.

These pricing decisions likely reflect the lack of significant changes and the ongoing global smartphone slump. 🔻

A new action button, USB-C charging port, a titanium shell, 72-hour battery life, camera improvements, and several other changes were announced. But nothing that caused investors (or users) to be that impressed. 📱

In addition to those iPhone changes, the company announced several other products, including the Apple Watch Ultra 2, iOS 17 and other software updates, satellite-based roadside assistance, etc.

As for the stock, shares fell about 2% on the day and remain stuck below their 2022 highs near 180-183. Technical analysts have been concerned about the stock since its post-earnings trend break in early August. They say its inability to reclaim those highs signals potentially more pain ahead. ⚠️

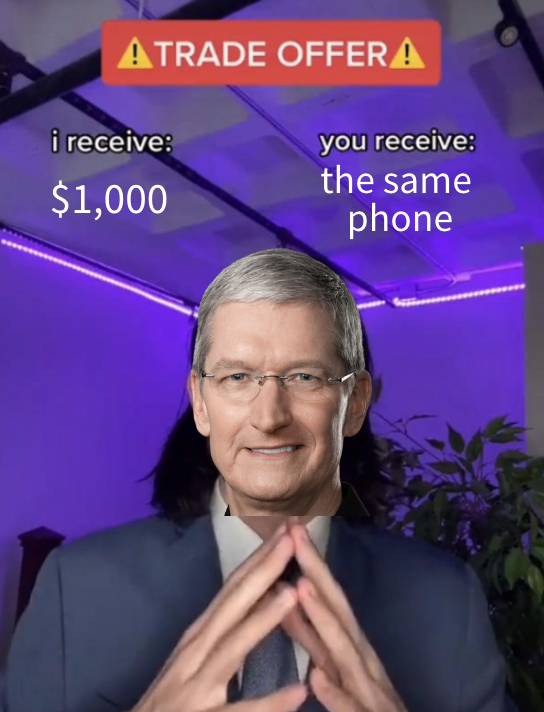

We’ll have to wait and see. In the meantime, we can all continue to enjoy the many memes the internet spun out about the lackluster event. 😂