Roughly four months after we last discussed Siemens Energy, the company is back in the news. 📰

Before getting into today’s news, the energy giant made headlines in June after scrapping its profit forecast and warning that major setbacks at its wind turbine subsidiary (Siemens Gamesa) could last years. That sent shares tumbling 37% in about two days, also pressuring Siemens AG, which owns about 35% of the company.

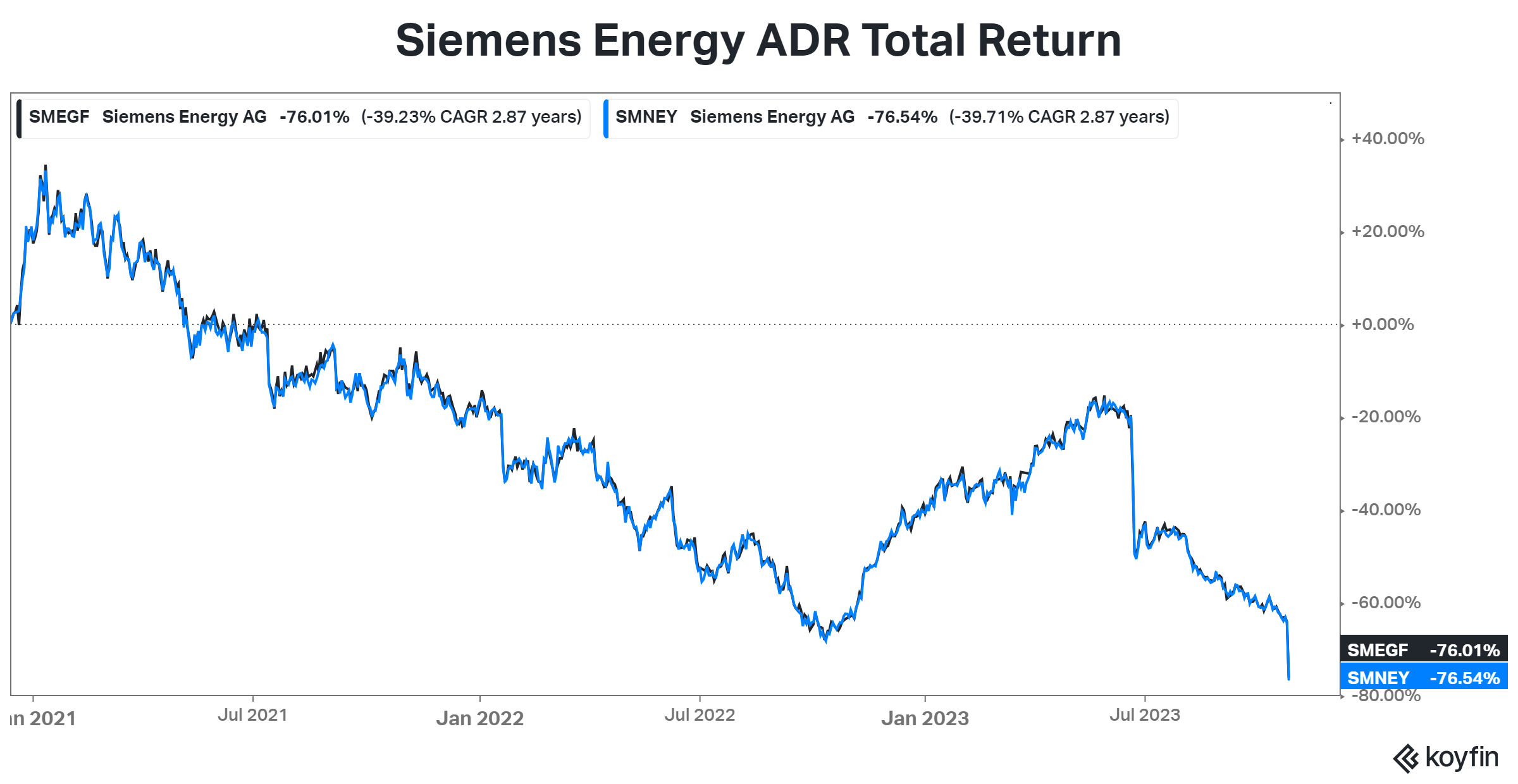

Now, the stock has fallen another 35% after requesting guarantees from the government to continue its long-term projects. 🆘

Its statement said, “Considering this requirement, the Executive Board is evaluating various measures to strengthen the balance sheet of Siemens Energy and is in preliminary talks with different stakeholders, including banking partners and the German government, to ensure access to an increasing volume of guarantees necessary to facilitate the anticipated strong growth.”

Reports indicated that the company is looking for 15 billion euros in guarantees, but executives did not comment on the exact details. The market was a bit confused, however, since executives said they expect fiscal 2023 results to align with previous guidance. 🤔

The overall lack of clarity sent investors scrambling as the constant surprises erode confidence in management’s ability to turn this struggling ship around. The market will certainly receive more clarity during its fourth-quarter results on November 15th, but for now, it’s left to wonder about what new headwinds might emerge.

Both American Depositary Receipts (ADRs) tracking the stock fell to their lowest levels ever. 📉