After the company’s announcement that problems at its wind turbine unit could last for years, Siemens Energy shares are gone with the wind. 😱

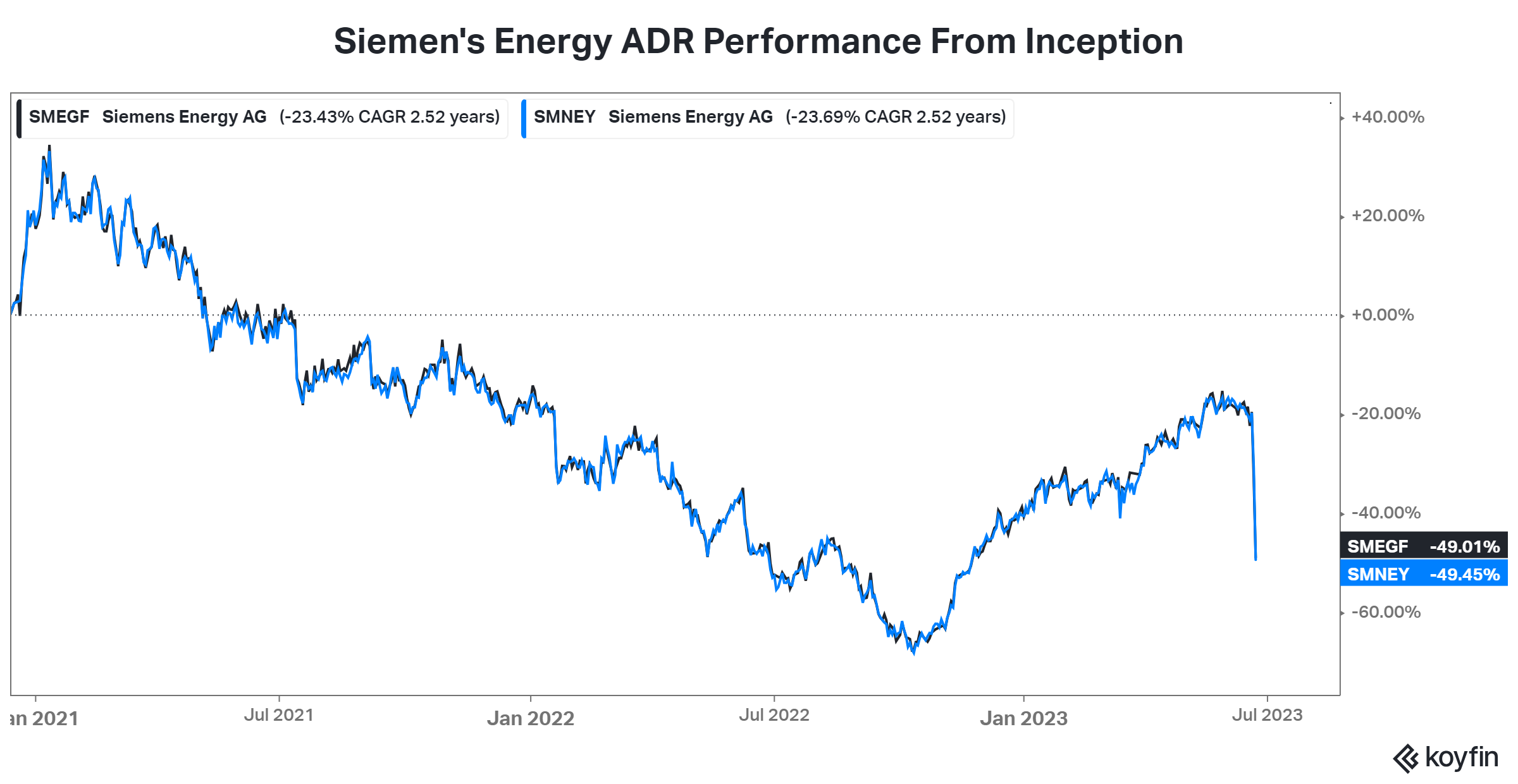

For background, Siemens Energy was created as a spinoff of German conglomerate Siemens AG’s former gas and power division. And it’s traded separately on exchanges abroad and in the U.S. as an American Depository Receipt (ADR) under ticker symbols $SMEGF and $SMNEY, which combined represent one Siemens ordinary share.

This week it announced that a review of issues as its Siemens Gamesa subsidiary uncovered a “substantial increase in failure rates of wind turbine components.” That news comes about a year after Siemens Energy acquired the remaining stake in this wind turbine unit, which was also publicly listed, for roughly 4 billion euros. While some issues existed at the time, its thesis was that it would be able to better address the renewable energy unit’s operational issues as a 100% owner vs. continuing to operate as a majority owner. 💰

Clearly, that has not panned out as anticipated, with cultural differences plaguing the two companies’ combination. ⚔️

With the additional skeletons being discovered this week, many shareholders question management’s leadership. How can investors rely on the company’s forecasts now if management doesn’t have a clear handle on the situation? Did they not adequately understand the risks before approving last year’s buyout? Many questions remain.

And with executives expecting the new quality issues could impact up to 30% of Siemens Gamesa’s installed onshore fleet, things are unlikely to improve soon. For now, Siemens Gamesa’s board of directors initiated an extended technical review to improve product quality. It’s expected to raise costs by more than 1 billion euros, though the true impact is unlikely to be uncovered for some time. ❤️🩹

Ultimately, the scale of these operational problems shocked the market. Siemens Energy shares are down about 37% over the last two days on the news. Meanwhile, Siemens AG, which still owns about 35% of the company, was down just 4% and is sitting just below all-time highs. 🔻

Ultimately, it’s a very messy situation that management needs to get a handle on before their next report in August. We’ll see if the stock’s drop this week is enough to price in the potential longer-term damage or if investors feel the price should be even lower than it is today. 🤷