We last talked about Telecom stocks about six months ago, when their stocks came under significant pressure due to slowing growth, competition concerns, and regulatory issues. We then discussed them in October when investors dumped defensive stocks for higher-yielding treasuries with no risk.

Prices have since rebounded sharply with the broader market as investors priced in Fed rate cuts this year. However, Verizon was back in the news today for a not-so-great reason. Let’s dig in. 👇

The telecom giant reminded investors that selling landlines and internet connections to businesses is much tougher today than a few decades ago. As a result, it’s writing down the value of its business division that offers services to a wide range of companies. The $5.8 billion charge will impact its fourth-quarter results, which is why it’s warning investors ahead of time. ⚠️

Executives said a strategic review caused it to reduce its financial projections and revise the unit’s overall value, given that revenues fell 2.9% YoY through the first nine months of 2023. Competition from smaller rivals and the unbundling of phone and broadband products remain structural headwinds for the business

Luckily, Verizon still generates most of its profit from cellphone services as the largest U.S. wireless company by subscriber numbers. With that said, that segment is not without challenges. Competition from AT&T and T-Mobile has caused customer losses and slowed revenue growth, with fears that Dish Network could join the fray following its merger with Echostar. 📱

Overall, investors are on high alert ahead of these companies’ earnings reports. They’ll be watching closely to see how management discusses plans to drive revenue growth, as well as for potential risks they disclose, like the Environmental Protection Agency’s (EPA) probe into lead telecom cables. 📝

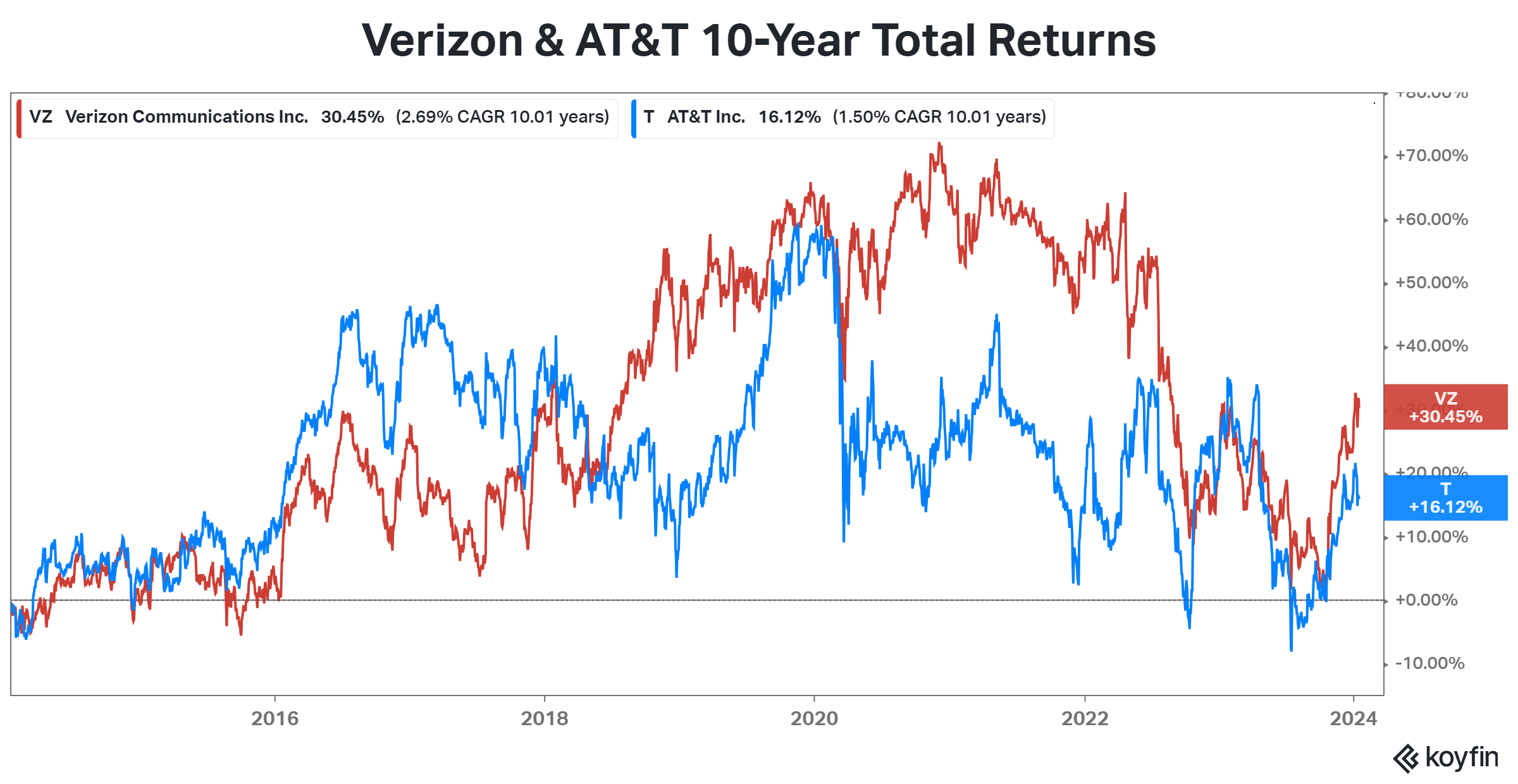

As for the stocks, it’s been a lackluster decade for $VZ and $T shares, while $TMUS (not shown) has risen over 400%. We’ll have to wait and see if they can turn things around this year. 📊