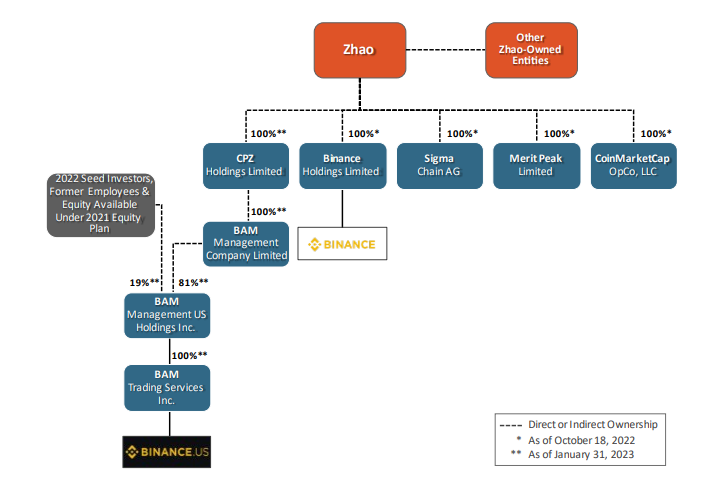

Before we dive in, let’s first get a look at the ‘Who Owns Who’ in this mess:

Here’s the summary of the allegations, which you can also read from the SEC here.

- Defendants have disregarded federal securities laws and enriched themselves at the expense of investors.

- Binance and BAM Trading have unlawfully solicited US investors through unregistered trading platforms.

- In addition, they have engaged in unregistered offers and sales of crypto asset securities and other investment schemes.

- BAM Trading and BAM Management have misrepresented surveillance and control over manipulative trading on the Binance.US Platform.

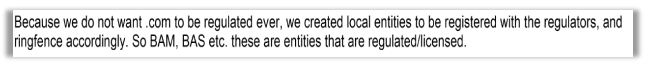

- Defendants have evaded registration and regulatory oversight designed to protect investors and markets.

- They have commingled and diverted investors’ assets without proper oversight.

- Defendants failed to implement adequate trade surveillance and manipulative trading controls on the Binance.US Platform.

- Sigma Chain engaged in wash trading to artificially inflate trading volumes on the platform.

- Binance and BAM Trading have violated securities laws by conducting unregistered offers and sales, evading registration, and operating with conflicts of interest.

- Their actions have violated the Securities Act of 1933 and the Securities Exchange Act of 1934.

- They have dodged disclosure and other requirements meant to protect capital markets and investors.

And here are a few of the damning facts as alleged by the SEC; as we review this hog of a filing, more will be added.

- Text or e-mail from Binance COO replying to an employee about blocking US customers showed they encourage US users to use a VPN to circumvent blocked access.

- Binance’s COO in 2018 admitted to a Binance compliance officer: “We are operating as a fking unlicensed securities exchange in the USA bro.”

-

From the SEC filing – click to enlarge. - There were strong efforts by Binance.US to wrest control and get more independence from CZ and Binance Corporate; the CEO even called it Project 1776, but that CEO was then fired.