The pullbacks are happening. 🔙

A good chunk of the top 25 market cap cryptocurrencies have one thing in common: they’re correcting after some large gaps between the Tenkan-Sen and their daily candlestick bodies.

The bodies of candlesticks and the Tenkan-Sen don’t like to be far away from each other for very long. They’re like an unhealthy dependent relationship, and so they need to be within arms reach, or they freak out.

When those gaps occur, the balance of price and time is considered to be out of equilibrium. A return to equilibrium occurs in two ways: with price returning to the Tenkan-Sen (most common) or the Tenkan-Sen coming to the candlestick body.

And if you’d like to know more about the Ichimoku Kinko Hyo system, read more here.

Cardano

$ADA had six consecutive days of large gaps between the Tenkan-Sen and the candlestick bodies. ✨

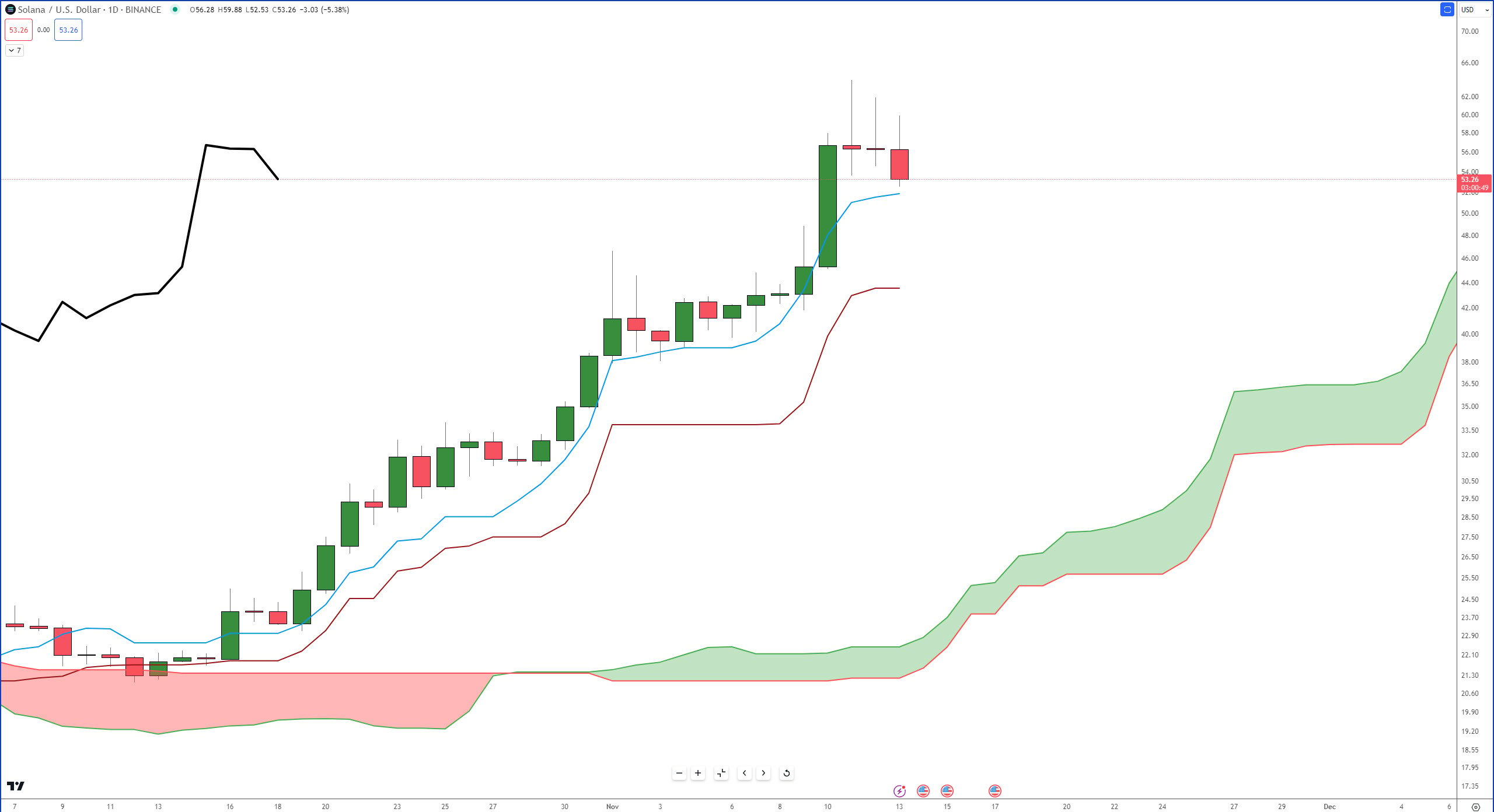

Solana

While the number of days with the gaps between the Tenkan-Sen and candlestick bodies is fewer than Cardano’s, $SOL is making an attempt to return to equilibrium. 👓

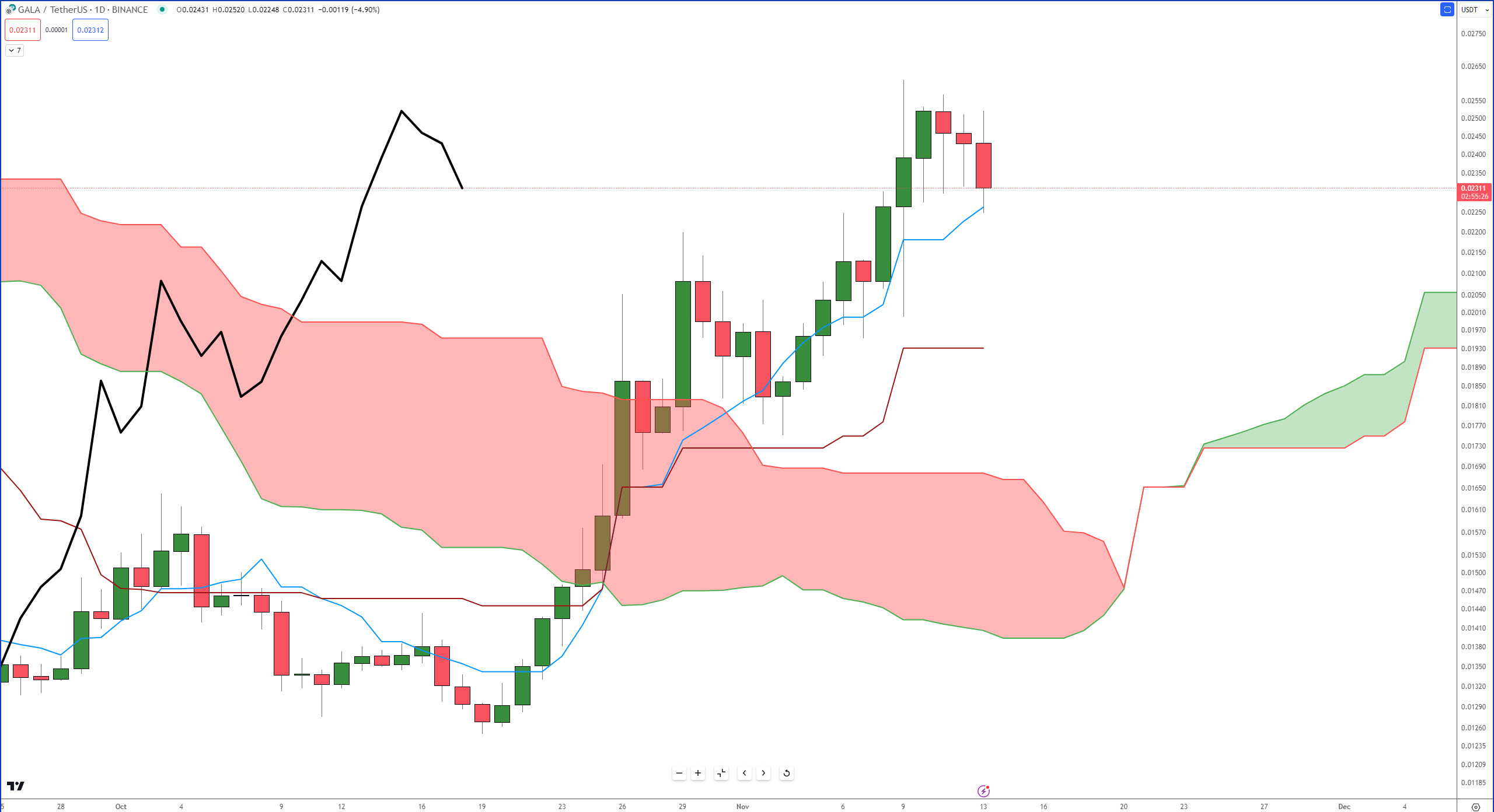

Gala Games

$GALA is likewise experiencing a pullback to the Tenkan-Sen.

Look at any of the major cryptocurrencies across any class, and you’ll likely see some version of the three examples shown here.

Whether this is just a minor pullback at the beginning of a broader bull run or a sucker’s rally before the resumption of the bear market remains to be seen. 👀