Here are two of the biggest questions rattling through every crypto trader and investor’s head:

- This rally is awesome, but can it keep going?

- We’re probably going to see a flash crash/pullback, right?

Let’s take a peak at Ethereum and see why there’s a sense of indecision out there.

Ethereum

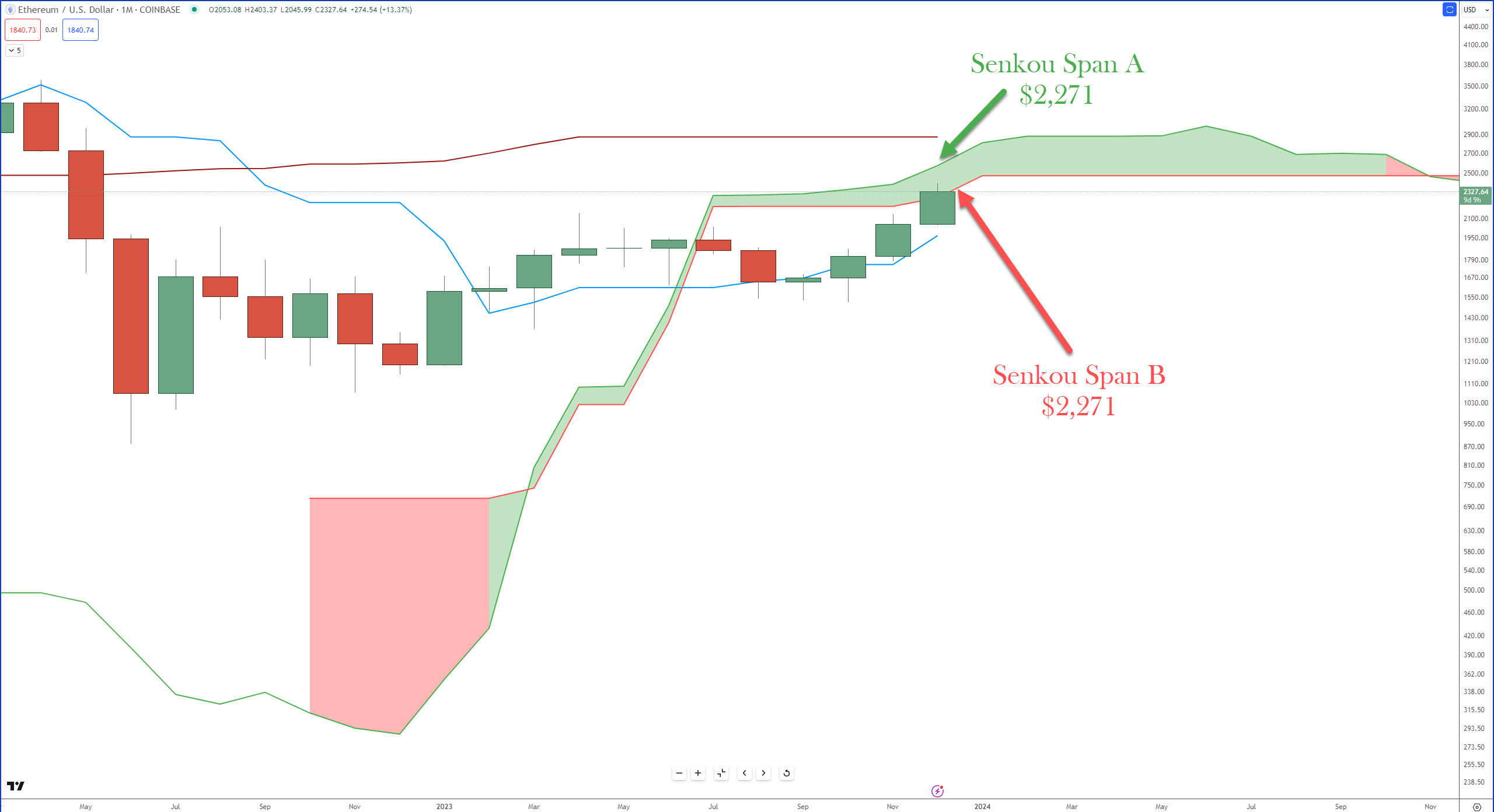

$ETH‘s monthly chart is probably one of the most ‘volatile’ looking charts out there.

Bulls are attempting to push Ethereum above Senkou Span B – the strongest support/resistance within the Ichimoku Kinko Hyo system – and have a week left to do it.

Now let’s look at the weekly chart:

At first, it may look like there’s no resistance ahead for Ethereum – but here’s where the genius of the Chikou Span comes into play. The Chikou Span reacts to the same support/resistance levels as the current price action does.

That means for the remainder of this week, resistance is Senkou Span B at $2,504 and $2,386 for next week.

From an oscillator perspecitve, the Composite Index is coming off of the highest levels since January 2021 – that by itself doesn’t mean a pullback is imminent, it may just signal a pause.

And a pause or consolidation might be the name of the game. The RSI just converted into bull market conditions.

Keep an eye on Ethereum’s weekly chart for a test of the Tenkan-Sen and Kijun-Sen as support. If this happens, check the RSI. If it’s between 40 and 50, it’s an ideal support level for bulls to maintain to push ETH’s price higher.

FYI

As we transition into a long weekend and the Christmas holiday, expect to see some shenanigans on the bullish and bearish side of the market.