When the first gold ETF came out, it took a couple of years to reach $10 billion in AuM (assets under management). How long did it take Blackrock’s $IBIT? 2 months. 😱

Bitcoin spot ETFs have now eclipsed the largest silver trusts regarding assets under management (AuM), setting their sights on surpassing gold trusts next. According to recent data from HODL15Capital, BlackRock’s IBIT has achieved an impressive milestone, amassing an AuM of $10.03 billion, translating to a remarkable year-to-date (YTD) increase of 35.2%.

https://twitter.com/HODL15Capital/status/1764123480373469255

This surge places the iShares Silver Trust ($SLV), with its $9.626 billion AuM and a 4.8% YTD decline, in the rearview mirror, marking a significant shift in investor preference towards digital assets over traditional commodities. Not far behind BlackRock in the crypto ETF space is Fidelity’s WiseOrigin Bitcoin ETF, boasting an AuM of $6.55 billion and mirroring BlackRock’s 35.2% YTD growth.

Stocktwits Sentiment Scores

How does the Stocktwits community feel about Bitcoin ETFs vs. silver or gold ETFs? Apparently, they like them both. A lot. 🤯

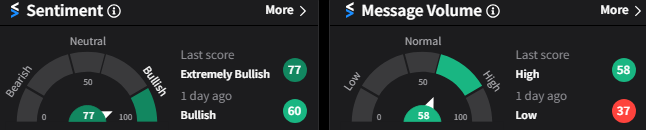

BTW – data on the Bitcoin ETFs is still very new, so we’ll just use $BTC as the stand in.

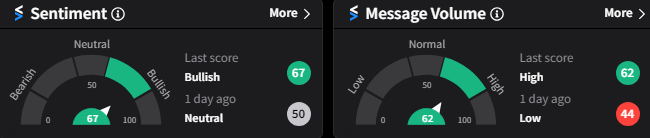

Gold ETF ($GLD)

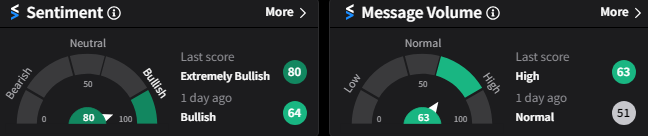

Silver ETF ($SLV)

Bitcoin ($BTC)