Some cryptocurrencies are pumping, some are experiencing selling pressure, and some look like they’re about to make another big move.

Let’s look at two of those now.

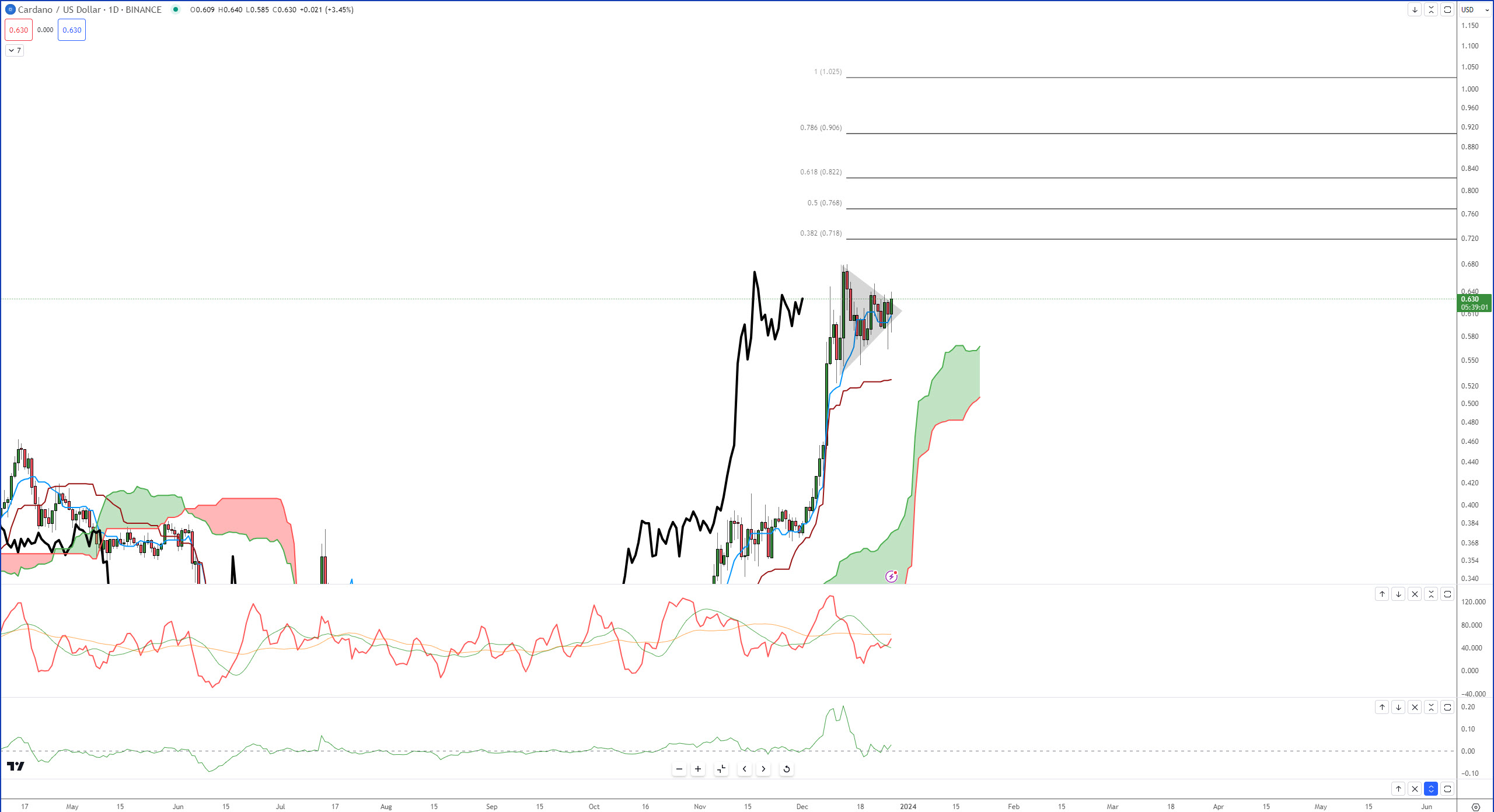

Cardano

On the daily chart, $ADA has returned to equilibrium and is presently in a standard bullish continuation pattern known as a bullish pennant.

The daily RSI and Detrended Price Oscillator are both in positions supporting a higher breakout.

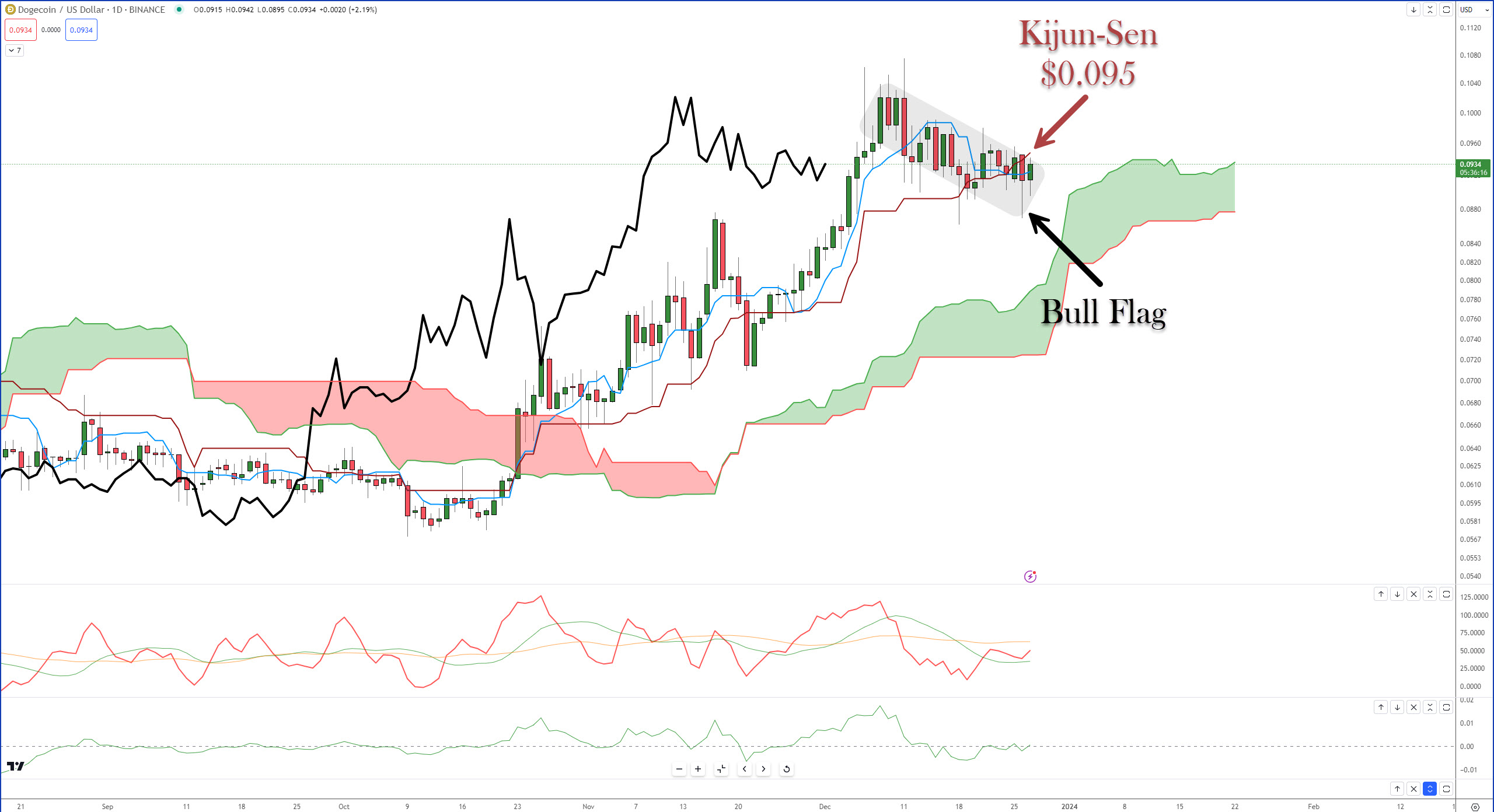

Dogecoin

$DOGE used to be Mr. Popular, but over the past couple of years, it has taken a back seat to $SHIB, and, most recently, $BONK.

From an oscillator perspective, things look very similar to Cardano’s. The key level bulls are looking for is a close above the Kijun-Sen, currently at $0.095.