Market Cap: $892 billion

YTD: +59.22%

Project Focus: Fetch.ai ($FET) is a decentralized machine-learning platform for smart infrastructure, finance, logistics, and more applications. It aims to create an Autonomous Economic Agent (AEA) network where agents can perform tasks autonomously, such as data sharing and decision-making, without human intervention.

What Makes It Unique: Fetch.ai introduces the concept of AEAs that can operate independently or collaboratively to solve complex problems. This approach to decentralizing AI tasks and the economy itself is groundbreaking, as it paves the way for a more efficient and automated future, where tasks are performed by intelligent agents negotiating with each other in a trustless ecosystem.

Fetch.ai didn’t close in the green yesterday, bucking the overall trend for any asset (crypto or otherwise) in the AI space. A daily close below the closest trendline could be a big warning to bulls that selling pressure may increase.

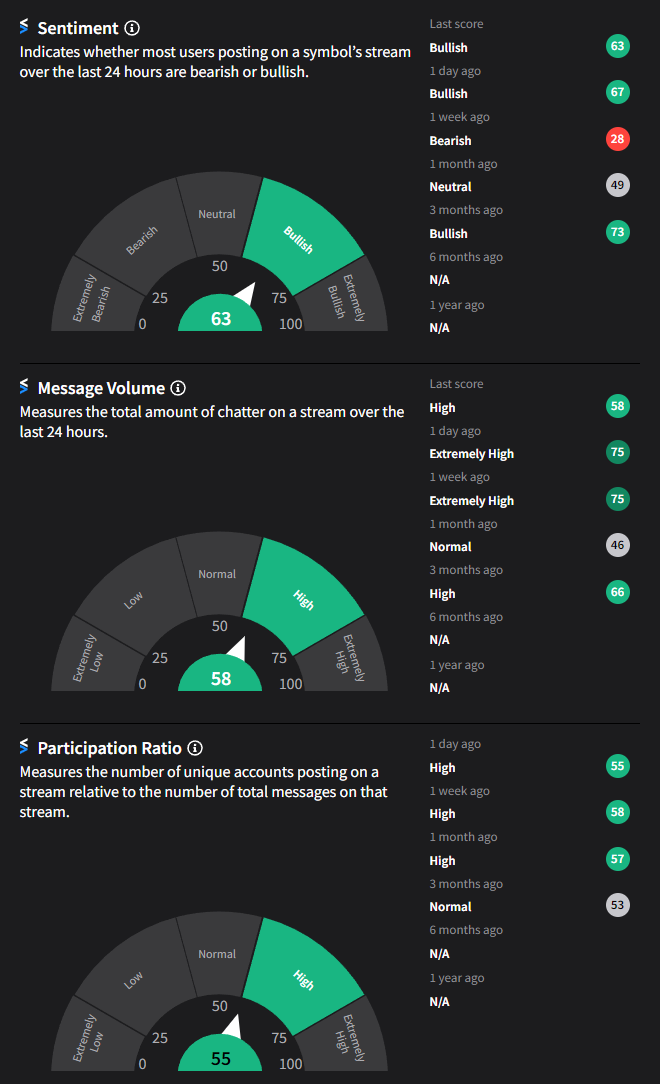

Stocktwits Sentiment Data for Fetch.ai