The work management platform, Asana, popped about 20% today after announcing several positive developments. 👍

First, let’s start with its better-than-expected Q2 earnings report. Its adjusted earnings per share of $0.34 were five cents better than analyst estimates, and revenues of $134.9 million beat estimates of $127.2 million. Additionally, its revenue guidance for the next quarter was also above estimates.

Other news catching investors’ attention is the company completing a $350 million private placement sale to its CEO Dustin Moskovitz. The company will use the proceeds for working capital and general corporate purposes. But more importantly, when a company executive buys a significant amount of stock, investors tend to take that as a big vote of confidence.

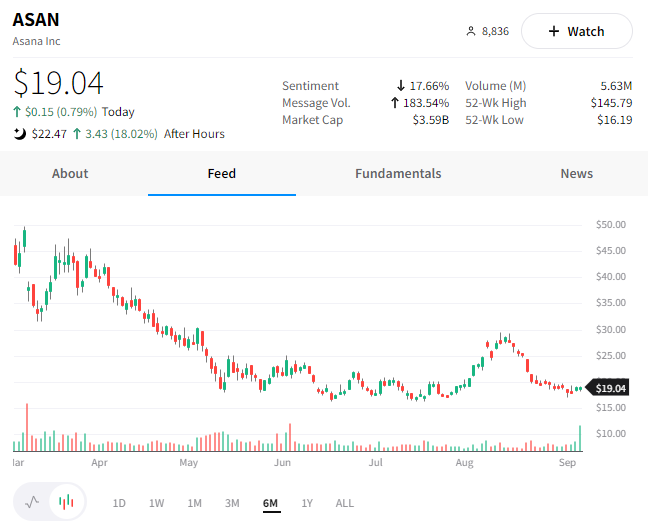

Like other software stocks, $ASAN shares fell heavily over the last year but have found traction near $16 since May. Whether or not today’s rally is the start of a more significant turnaround remains to be seen. Though today’s news shows, at least one guy is betting big on it. 👀