Semiconductors continue to dominate the market and thus dominate our headlines. With that said, today we’ve got a fresh stock breaking out and another setting up, so stick with us. 👇

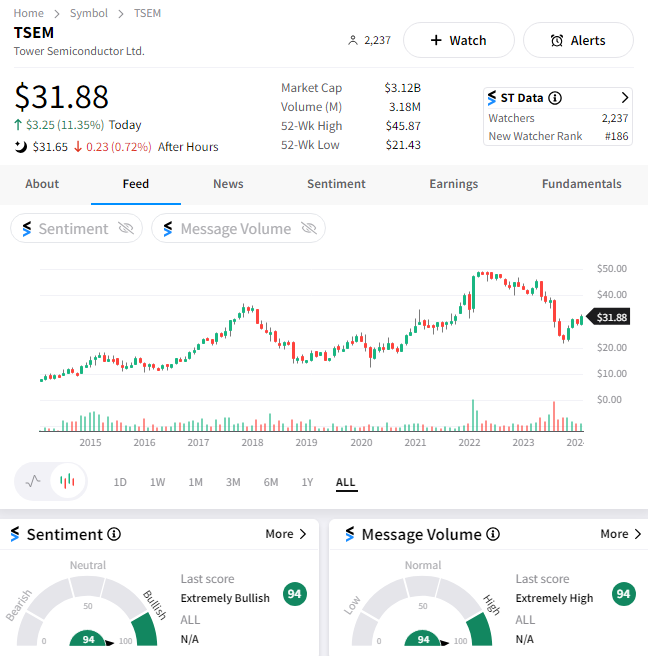

First up is Tower Semiconductor, an Israeli chip manufacturer that reported results today. The company’s revenue fell 13% YoY to $351.7 million during the fourth quarter but topped the $350 million expected by analysts. Its earnings per share were down about 30% YoY to $0.48, but again, better than anticipated. 🔺

Looking ahead, management affirmed the message we’ve heard from many companies in the space: the consumer technology chip glut is ending, and growth should pick up from here. As a result, it’s targeting notable QoQ growth throughout the year, with a first-quarter revenue target of $325 million (+/-5%).

The stocktwits community is bulled up on the stock, with message volume and sentiment surging after the results. 🐂

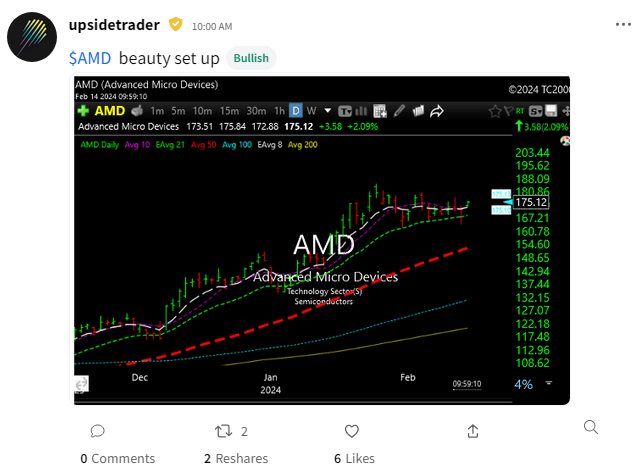

The positive news also boosted other stocks in the sector, with Stocktwits user upsidetrader highlighting Advanced Micro Devices, which looks to be on the verge of a breakout.

With prices looking to reaccelerate after a multi-week pullback, traders have this one on their radars for the coming days. 👀

The next major hurdle for the sector will be Nvidia’s earnings after the bell on February 21st. But for now, the investor/trader appetite for these stocks feels insatiable. 🤷