The online personal styling business might’ve been a solid bet during the ZIRP era, but it has really taken a beating in the post-pandemic world. Today, we heard from Stitch Fix and ThredUp, battling for survival in the public markets. 📦

First up, Stitch Fix reported a $0.29 per share loss on $330.40 million in revenues. Both numbers missed estimates of a $0.22 loss and $330.88 million. Looking ahead, the company’s third-quarter revenue guidance of $300 to $310 million also missed expectations. 🔻

On the positive side, the company has no bank debt and about $230 million in cash, so it has some time to figure things out. But with cash flow from continuing operators at negative $26.10 million, investors aren’t being as patient as the company might hope they’d be.

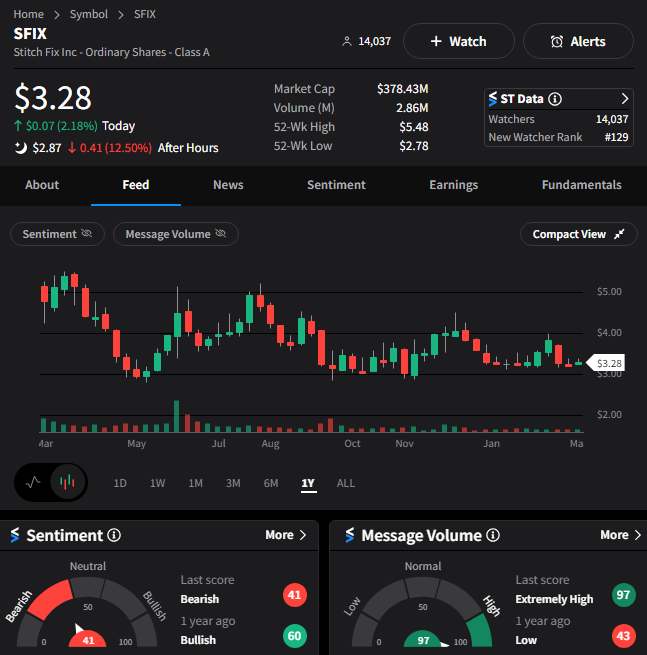

$SFIX shares are down about 12.50% after the bell, nearing all-time lows. 📉

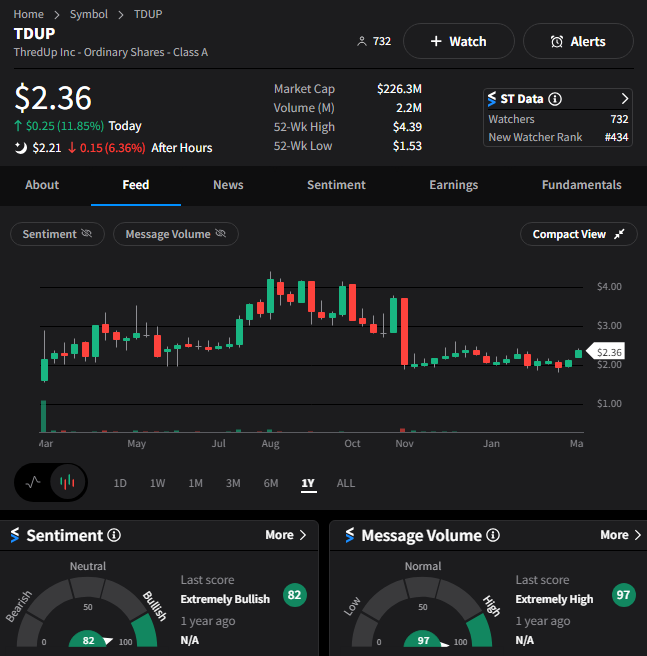

Competitor ThredUp had a mixed report, with a $0.14 per share loss and revenues of $81.40 million. Earnings were $0.01 shy of expectations, while revenue beat by about $1 million.

The company expects full-year 2024 revenue of $340 to $350 million, while Wall Street anticipated $343.10 million. Despite that, $TDUP shares are still down about 6.50% after the bell as investors assess the company’s long-term viability. 🤔

With these companies experiencing weak or declining revenues and margins, investors are looking for some sort of turnaround plan from management. So far, there’s not been much to grab onto, especially with many other stocks and industry groups performing so well. 👎

As always, we’ll have to wait and see. But for right now, the boxed clothing companies are battling it out for survival.