Network provider Cloudflare is surging after the bell following better-than-expected results. 📝

The company’s adjusted earnings per share of $0.15 on $362.50 million in revenues topped estimates of $0.12 and $353.10 million. YoY revenue growth of 32% was consistent with its third quarter, while its GAAP net loss narrowed significantly from the year prior.

CEO Matthew Prince said Cloudflare signed its largest new customer deal and biggest renewal to date, driving the highest annual contract value in corporate history. It also made significant progress in delivering software developers graphics processing units they can use for artificial intelligence. It had hoped to deliver 100 units by the end of 2023 but exceeded that goal by 20%. 📊

It’s also aiming to grow by selling security services to companies and government agencies. During the earnings call, management mentioned business with the U.S. Commerce Department, sparking further speculation among investors.

The company’s first-quarter guidance numbers align with Wall Street’s consensus. However, its full-year earnings outlook marginally beat estimates while revenues lagged. 🔮

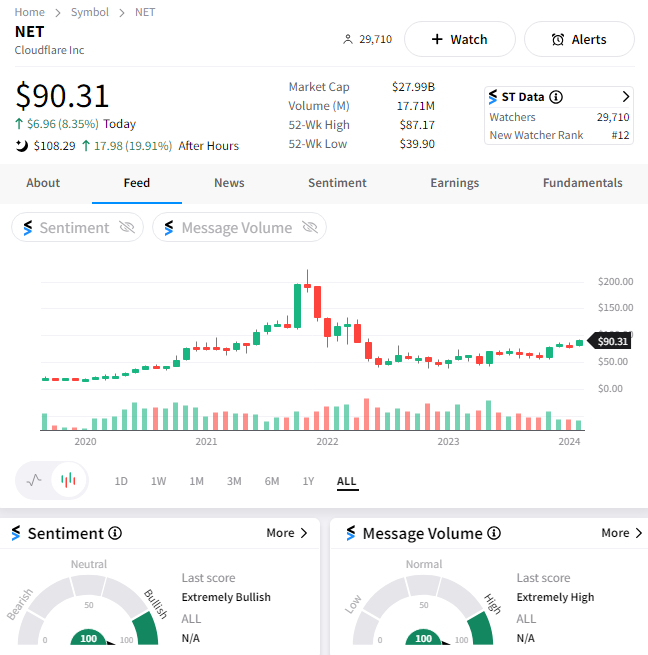

Overall, the Stocktwits community is bulled up as the stock soars 20% after hours, adding to an 8% regular-session gain. Looks like bears will need a new beaten-down tech stock to bet against, at least for the time being… 🤷