The current market environment has not been kind to renewable energy stocks like electric vehicle makers or solar manufacturers. And that trend continued today with lackluster earnings results. 👎

Rivian kicked it off by saying that it’s laying off 10% of its workforce due to EV pricing pressures. Although it built and shipped more than double the vehicles it did in 2022, its 2023 losses still totaled more than $5.40 billion. 🪫

Lucid Motors didn’t fare much better, now predicting it will build just 9,000 EVs in 2024. That’s down from previous estimates of 90,000… It’s no big deal, just an extra zero on there. Its 2023 financial results showed the company lost $2.80 billion as it slashed prices to stoke demand.

SolarEdge tumbled sharply after issuing weaker-than-expected first-quarter guidance yesterday. Weak is putting it lightly, with management forecasting less than half of what Wall Street had anticipated. Elevated interest rates have depressed residential solar market demand, leaving the company (and its competitors) with a large inventory backlog to work through. ⛈️

SunRun followed suit today, with its revenues also missing expectations amid slumping demand. Its CEO and management feel confident that installations will grow considerably from current levels, but the market isn’t buying that narrative just yet.

For solar and electric vehicle stocks, it’s all about the numbers. Until demand stabilizes and these companies give investors confidence that further dilution isn’t coming, they will likely remain in a downward spiral. 😵💫

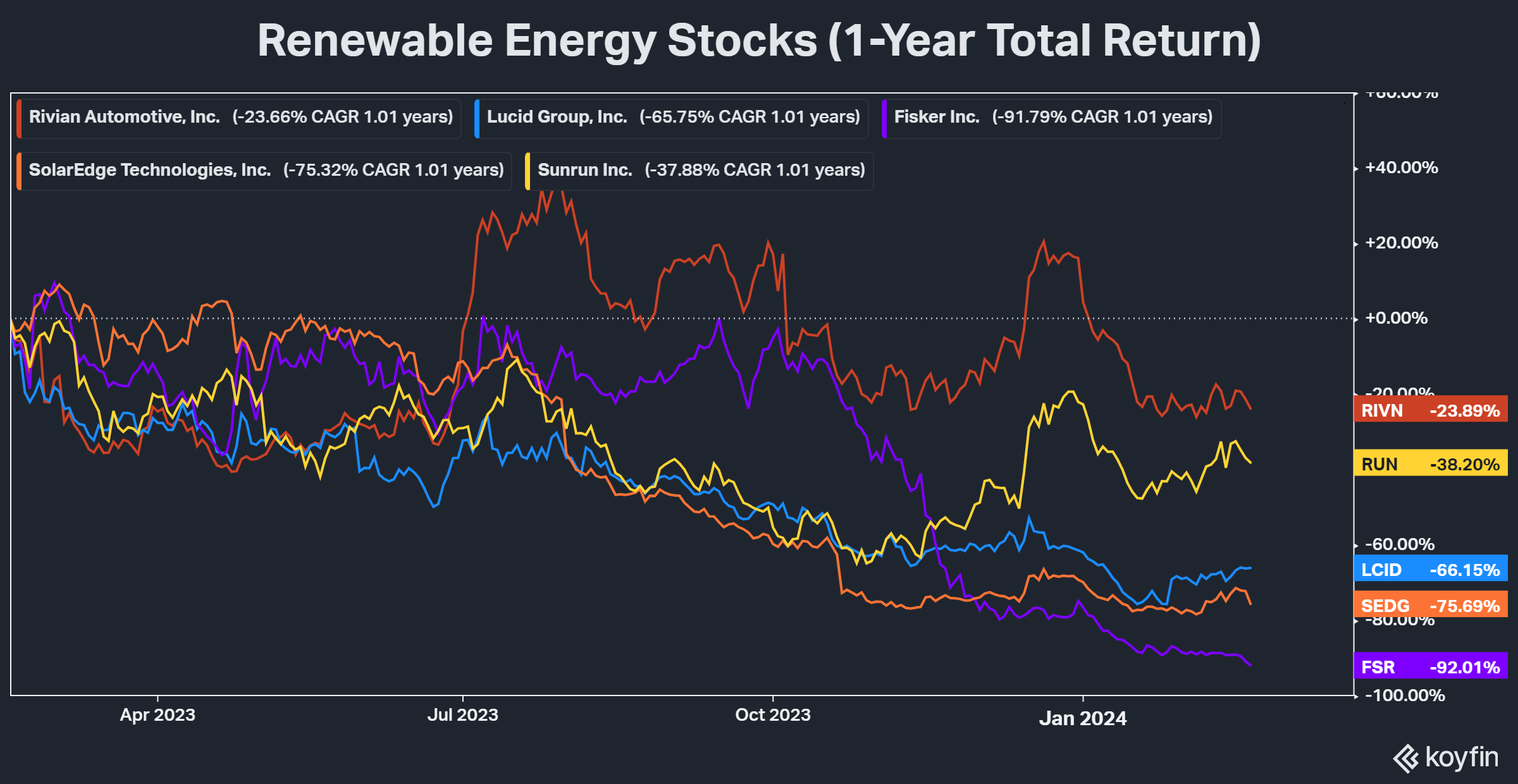

Here’s a peek at the stocks mentioned and their 1-year total return. It’s not a great look in a market environment where most sectors and industry groups have charged higher with the bulls. 🤷