While this post may look the same as yesterday’s, trust us, it’s not. We’ve got a new batch of earnings disasters for y’all to marvel at. 😮

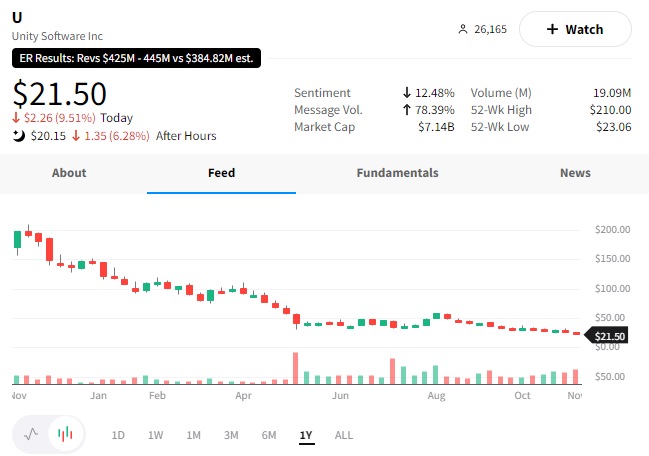

First up, we’ve got Unity Software. The company’s shares fell 15% to a new all-time low after its revenues missed Wall Street expectations. The company hiked its full-year revenue expectations, but not enough to surpass the original forecast they cut just last quarter. As we’ve seen, a “so-so” report isn’t enough to keep investors interested in the current environment.

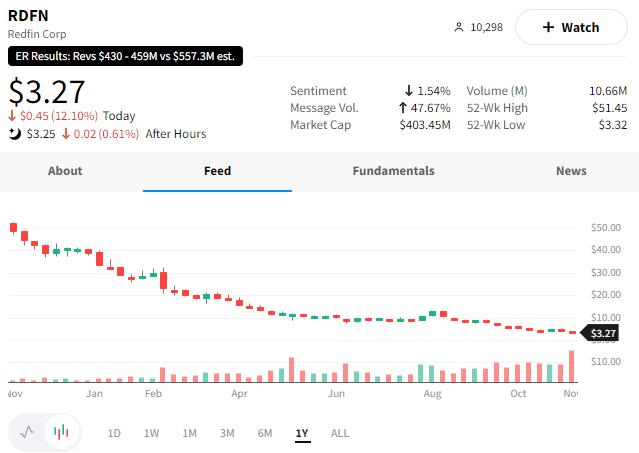

Redfin shares offered investors no shelter in the storm, falling another 12% today to fresh all-time lows. The company reported a quarterly loss slightly lower than expected, but its revenues missed expectations by a small margin. More importantly, the company announced it is shutting its home-flipping business and cutting another 13% of its workforce as it tries to survive.

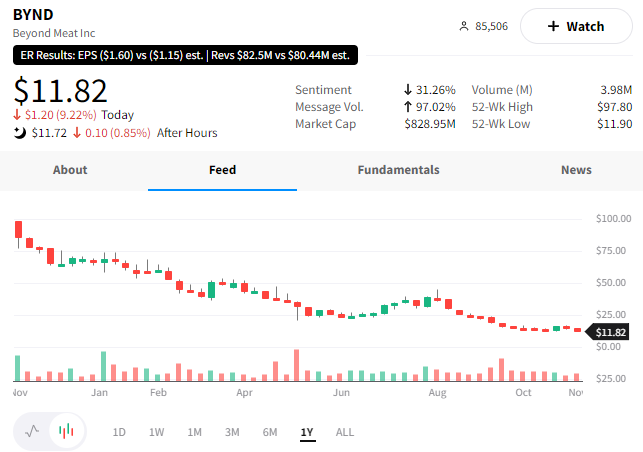

Beyond Meat investors saw shares fall to fresh all-time lows ahead of its after-hours earnings report, where it reported a wider-than-expected loss and falling revenues. Net sales fell another 22.5% despite the company’s efforts to revive demand by offering grocery and restaurant consumer discounts.

Like yesterday, we’re going to end things on a slightly more positive note. Of course, I’m not sure that clawing back half the day’s losses qualifies as a real positive. But in this environment, investors will take what they can get… ☠️

Anyway, here’s Rivian Automotive, which reported a smaller-than-expected loss while missing on revenues. Nevertheless, the electric vehicle maker reaffirmed its 25,000-vehicle production target for 2022 and said it plans to cut costs further to preserve its runway in the current environment.