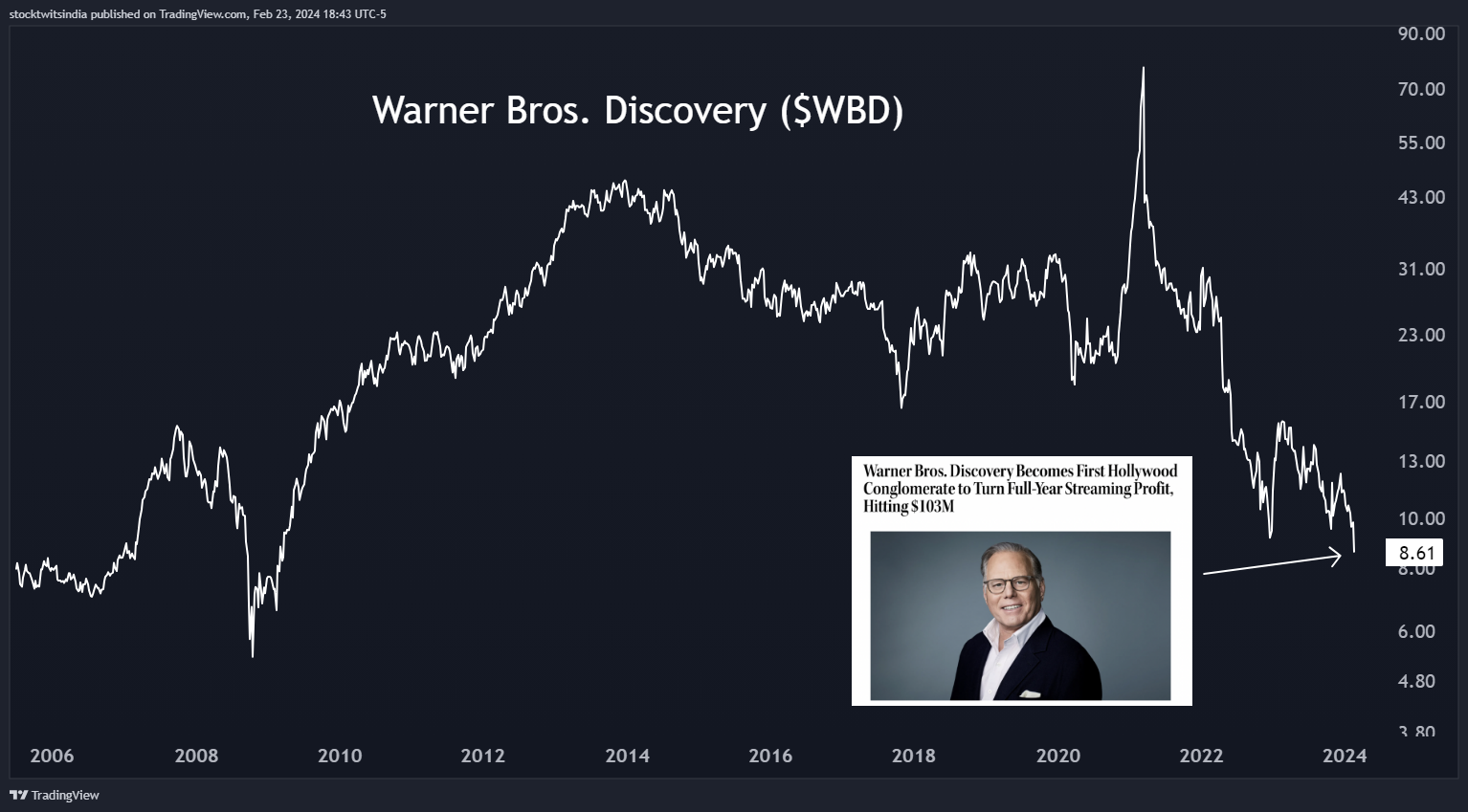

One of the perplexing things about markets is that sometimes headlines don’t necessarily match the reaction in markets. And that was certainly the case today in struggling media giant Warner Bros. Discovery. 📰

The Hollywood Reporter wrote an article boasting that Warner Bros became the first Hollywood conglomerate to turn a full-year streaming profit ($103 million).

With a headline like that, you’d expect the stock to go gangbusters. Especially since major competitors like Disney have yet to reach that milestone, Warner Bros. must be doing something well, right??? 🤔

Well, not exactly. $WBD shares fell another 10% to their lowest level in about 15 years.

That’s likely because the broader story is that the company missed revenue and earnings estimates, with advertising taking a significant hit in 2023. Management also said there will be free cash flow headwinds in 2024 as its content spending increases, declining to offer guidance for the year.

It is not exactly the picture-perfect situation that initial headlines indicated. The truth is that the media landscape remains incredibly challenged, and those conglomerates with other businesses to offset their media operations will continue to outperform.

So, while we commend Warner Bros. streaming service Max for its profitability, the company has much bigger problems to deal with. And that’s why the market continues to sell its shares in the face of seemingly decent news. 😩