Disney has been struggling with a number of issues ranging from streaming losses to activist investor and political pressures. However, today’s earnings report offered some hope to investors betting on a longer-term turnaround in the stock. 🕊️

The media giant reported $1.22 in adjusted earnings per share on $23.55 billion in revenues. Earnings topped estimates, while revenues were just shy.

The company’s direct-to-consumer unit reported a $138 million operating loss. But if you include ESPN+, losses across all streaming platforms fell about 80% YoY to $216 million. Cost cuts, price hikes, and investments in content continue to drive the unit toward profitability. 📺

Speaking of content investments, investors were thrilled to hear that Disney is taking a $1.5 billion stake in Fortnite’s parent company, Epic Games, marking its largest jump into the gaming world yet. Disney will work with the gaming studio on new games and an entertainment universe. 💰

It’s also betting that Taylor Swift can boost Disney+ subscriptions. Beginning March 15th, the company will bring an “exclusive” version of her Era’s Tour movie to the platform. With the NFL and every other brand looking to capitalize on her stardom, Disney wants its piece of the action, too. 🌠

Overall, it appears investors were happy to hear the updates and significant media investments that will serve the company long-term. If the company can push its streaming businesses into profitability and fight off these messy proxy battles, the market may back off enough to let Bob Iger and his team do their thing.

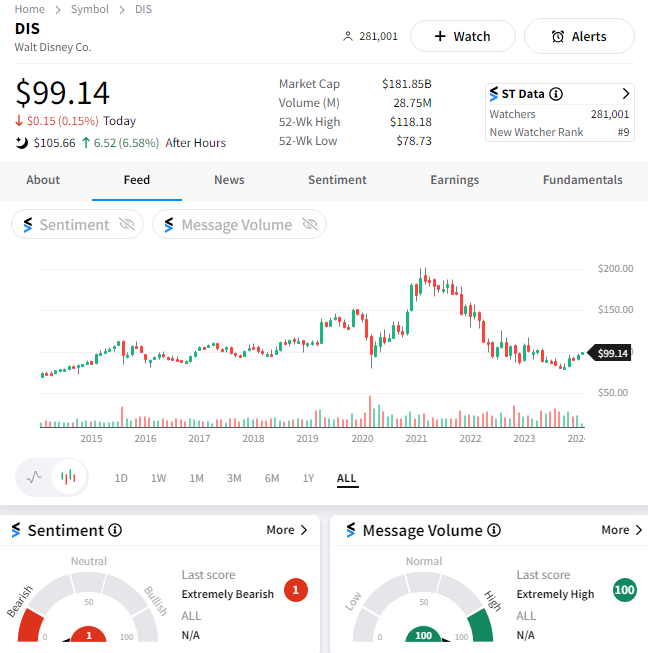

Despite the stock popping 7% after hours, the Stocktwits community is still skeptical. Current sentiment readings are in “extremely bearish” territory as the debate rages on. ⚔️