Diamond hands paid off for Signet Jewelers ($SIG) investors today as the company behind Kay Jewelers, Zales, and many expensive decisions reported better-than-expected earnings. 🤩

The company saw sales rise $2.9% YoY to $1.58 billion (vs. the $1.50 billion expected). The company’s North American same-store sales were down 7.6% YoY, but higher prices caused total sales to rise 5.1% YoY. Meanwhile, international sales fell 21.2% YoY to $95.3 million.

The company faced higher costs, with gross margins contracting 250 bps to 34.9% and operating margins shrinking from 7% to 3%. 🔻

Cash and cash equivalents were down roughly $1.2 billion from Q3 of FY22, with a good chunk of that due to the acquisition of Diamonds Direct and Blue Nile – a topic we reviewed in August.

Despite rising costs and the macroeconomy pressuring consumers, the company raised its full-year guidance. It now expects sales of $7.77 to $7.84 billion, higher than its previous view and consensus estimates. Additionally, it raised its earnings guidance to $11.40 to $12.00 per share, above estimates of $10.90.

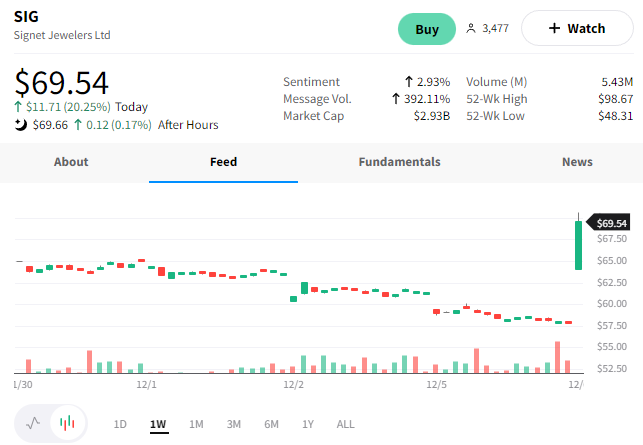

Signet shares shined in a deeply red tape, rising +20.25% on the day.💎