Neobanks that came public during the pandemic at insane valuations and got crushed over the last few years are roaring back in the current environment. 🏦

Dave Inc. is a digital banking service primarily focusing on cash advances, working off tips and subscription fees rather than overdraft fees. That was a solid business in the ZIRP era of cheap money but faced a reckoning in a higher interest rate environment. 💸

With that said, the company may have found its balance recently, reporting a significant profitability milestone during its latest quarterly results. While its revenue growth has slowed from 45% in Q4 2022 to 23% YoY in 2023, its adjusted EBITDA of $10 million marked its first positive quarter.

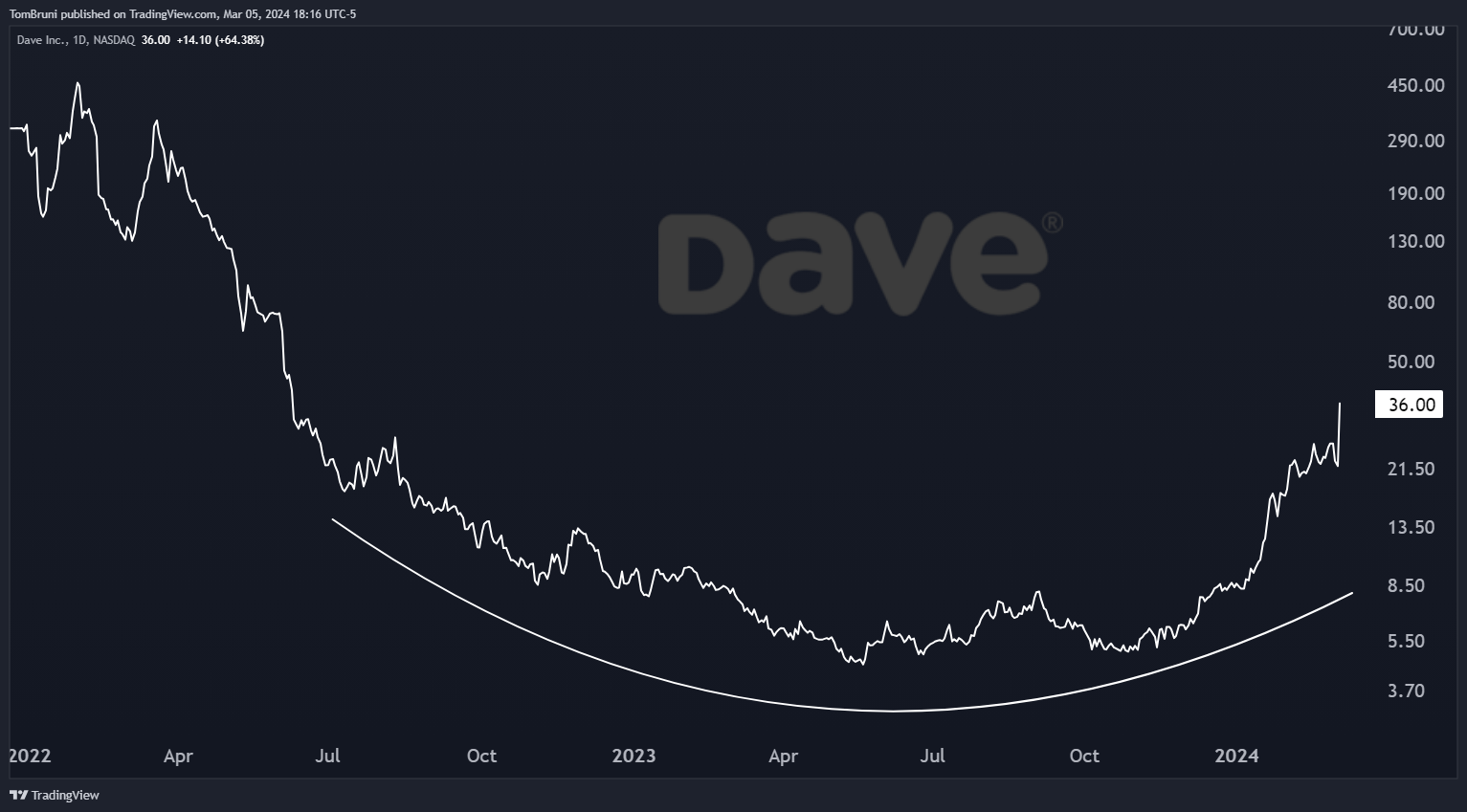

That was enough to help squeeze the beaten-down stock higher, with $DAVE shares rising 64% on the day. Technical analysts have also pointed out the stock’s “monster’ basing pattern from the last eighteen months that it’s now breaking firmly out of. In the renewed age of speculation, plays like this continue to catch traders’ attention big time. 🤑

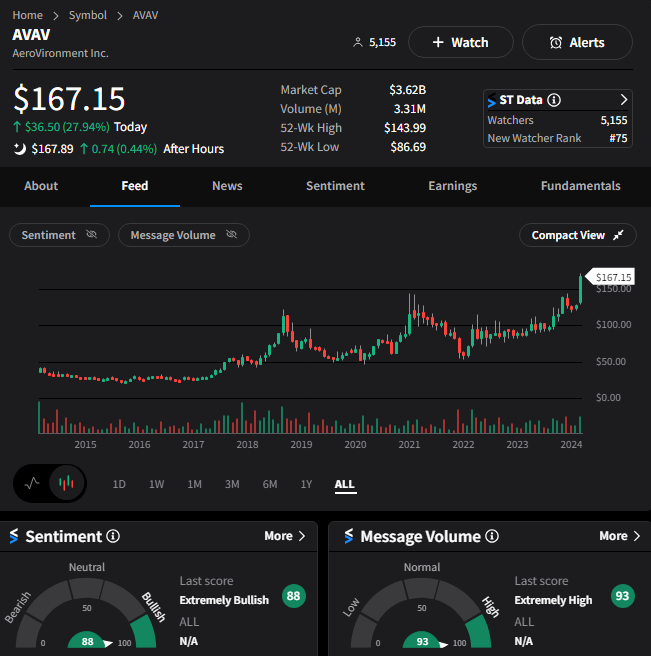

Speaking of somewhat speculative plays, AeroVironment soared to new all-time highs after its third-quarter results and full-year guidance topped analyst expectations. ✈️

The defense supplier topped quarterly estimates and boosted its guidance as demand for unmanned aircraft missiles and ground vehicles remains robust. Investors were also to see a solidly funded backlog from the company, which means it’s got significant orders still to fulfill. 📝

$AVAV shares soared 28% to fresh all-time highs on the news, with the Stocktwits community continuing its “extremely bullish” stance. 👍