Earnings season is a tough time for investors in several retail favorites, including Snowflake and AMC Entertainment. Let’s quickly see how they fared during their most recent quarters. 👇

We’ll start with everyone’s favorite movie theatre chain, AMC Entertainment. The company beat earnings and revenue expectations during the fourth quarter, but the stock is still falling after hours.

That’s likely because CEO Adam Aaron said that “literally all” of the increase in fourth-quarter revenue was driven by Taylor Swift and Beyonce’s films. Total attendance grew 4.70% YoY to 51.90 million, yet the company reported a net loss and negative free cash flow. ☹️

With two consecutive quarters of blockbuster movies failing to produce cash from operations, investors are rightfully worried about further dilution. It also signals that much of the company’s success will depend on Hollywood producing blowout films every quarter if it has any chance at a sustained turnaround. 😬

After all, the company raised $865 million in cash from equity offerings in 2023 and paid off just $448.10 million in debt. With its debt and finance leases totaling $4.60 billion at the end of the quarter, the company will need cash eventually. And with it not coming from operations, the only other place it can come from is asset (or equity) sales.

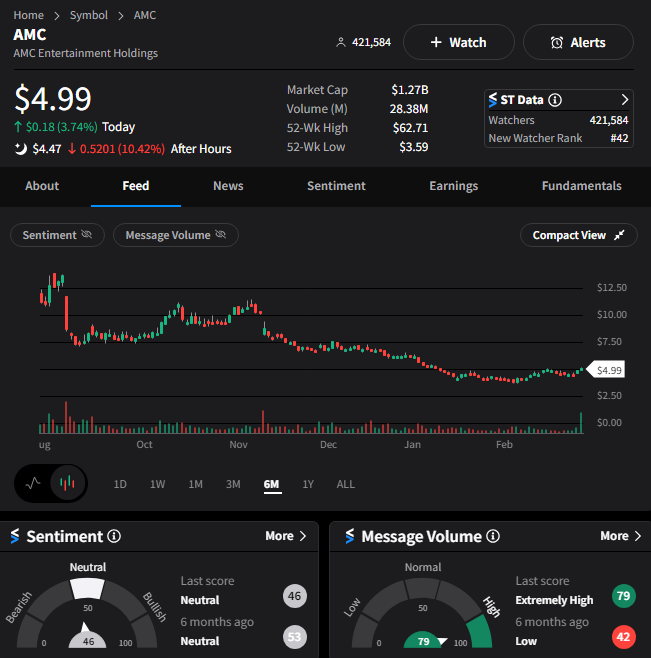

Ultimately, the company has revenue and profitability problems. Until it can generate free cash flow from its core movie business, the risk of further dilution will be a major overhang for the stock. The bull vs. bear debate is raging on Stocktwits, with sentiment currently sitting in neutral territory.

Meanwhile, $AMC shares are down about 10% after the bell. ⚔️

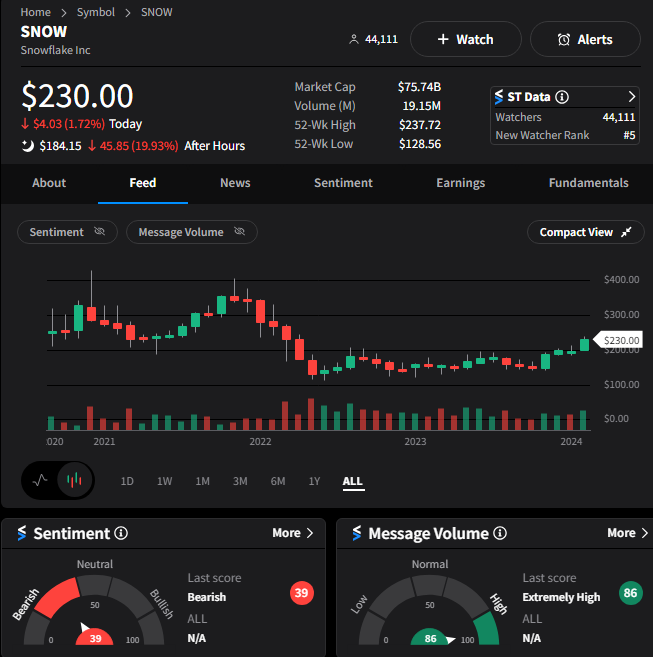

Next up is cloud company Snowflake. The main story here is the surprise change in CEO it announced. CEO Frank Slootman has retired effective immediately and will be replaced by the company’s senior vice president of AI, Sridhar Ramaswamy. 👨💼

The transition and a weaker-than-anticipated revenue outlook will undoubtedly take the market some time to digest. As a result, $SNOW shares plummeted 20% after the bell, with the Stocktwits community seemingly bearish on the stock following the news. 🐻