Animal spirits have been a big theme of this newsletter since October, and boy, are things getting wild. While the mainstream media continues focusing on tech giants like Nvidia, investors and traders are searching far and wide for new opportunities to squeeze the shorts and make a killing. 🕵️♂️

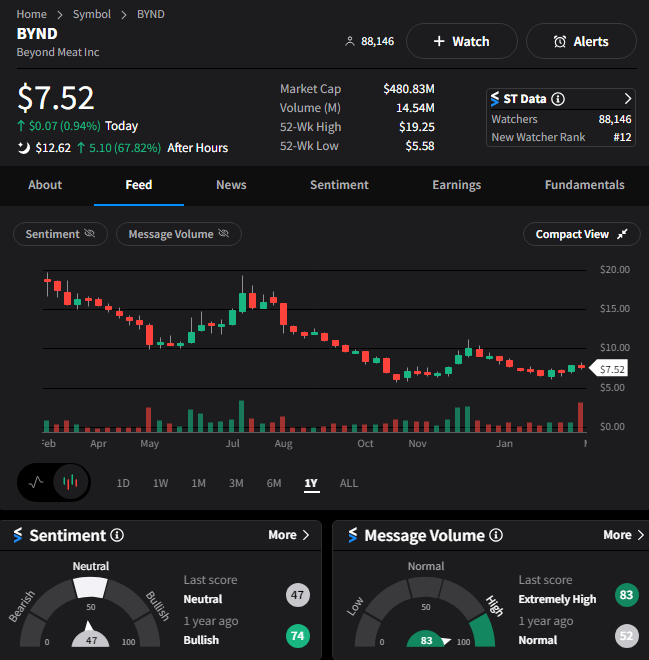

Today’s surefire sign of this speculative fervor building in the market is everyone’s favorite non-meat meat stock, Beyond Meat. 🫨

The company’s share price is soaring despite reporting a $2.40 per share net loss and a nearly 10% YoY revenue decline to $73.70 million. While revenues beat expectations, its net loss was far wider than expected.

Even the company’s net revenue guidance of $315 to $345 million for 2024 was lackluster compared to analyst estimates of $344.40 million. But management’s focus on cost-cutting and forecast for gross margins in the mid to high teens range sent investors into a frenzy. That would be a crazy difference compared to 2023, where gross margins were firmly in negative territory. 🤯

However, traders (and algos trading the news) do not care how the company plans to meet that outlandish forecast. All they heard was a 20-point increase in gross margin is coming this year, which would be an absolute game-changer for the company.

Objectively, this is a crazy measure the company is unlikely to meet, but with 36% of the float short, there’s a ton of squeeze potential. That’s why shares are up over 75% after hours and will likely remain on traders’ radars in the days and weeks ahead. 📈

And if you need more evidence that this “pain trade” for shorts is back in action, take a look at the charts of stocks like Carvana, Big Lots, Robinhood, and more. You’ll get the gist real quick. 😆

We all know how this will eventually end, but for now, the Bulls are partying like it’s 2021 all over again. Enjoy responsibly. 🍻