Earnings announcements remain sporadic, but there were several big movers of note today. Let’s dive in. 🤿

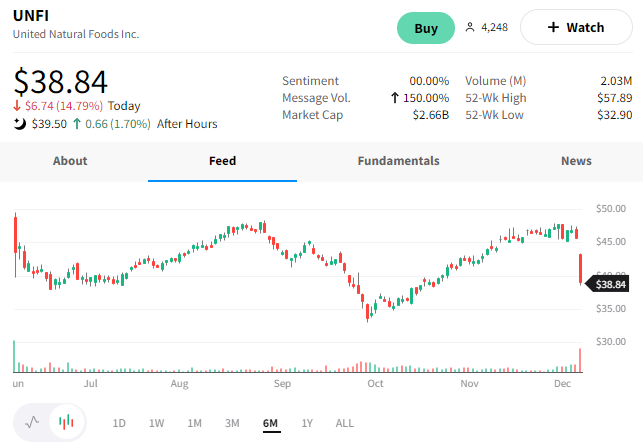

United Natural Foods is the country’s largest organic and natural food wholesaler. Unfortunately, its investors will be able to buy slightly less expensive food after today’s drop.

The company’s revenue rose 7.6% to $7.53 billion, beating the $7.48 expected. However, its gross margin fell 34 bps to 14.55%, causing earnings per share of $1.13 to miss expectations of $1.15. 📉

Wholesaler’s gross margins are the key metric investor’s track. And a declining gross margin shows the company is struggling to pass along costs to its customers. As a result, its guidance for the full year also came in slightly below analyst estimates.

Overall, the lack of earnings growth despite higher food prices caused $UNFI shares to fall 15%. 🤢

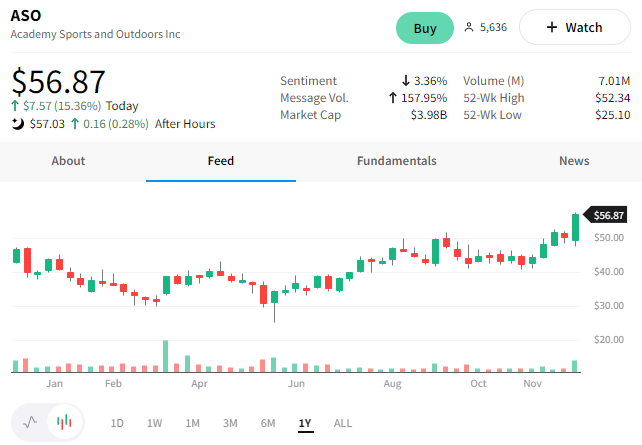

Academy Sports and Outdoors, Inc. rose to a fresh all-time high after it reported better-than-expected Q3 results. 🏀

The company’s earnings per share of $1.69 beat estimates of $1.64. Revenues of $1.49 billion fell by $0.10 billion YoY and missed expectations.

On a positive note, the company updated its fiscal year 2022 earnings guidance above estimates, though revenue guidance was soft.

Overall, investors are assigning more value to the improving earnings picture than the lack of revenue growth. $ASO shares rose 15% to a new all-time high. 📈

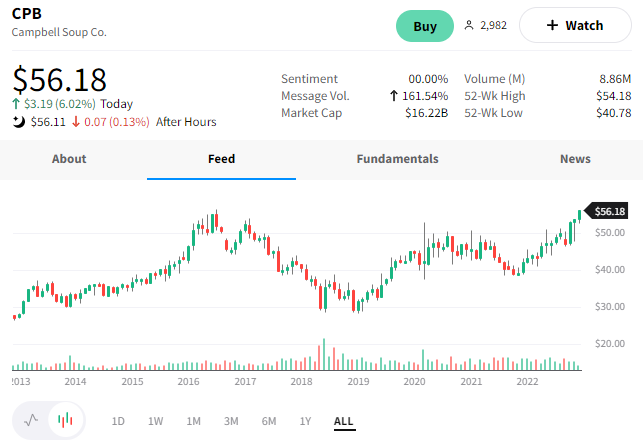

Campbell Soup delivered a better-than-expected earnings report. 😋

The American processed food and snack company saw its sales grow 15% YoY to $2.58 billion, ahead of the $2.45 billion expected. Adjusted earnings per share of $1.02 also beat the $0.88 expected.

The company’s gross margin rose ten bps to 32.4%, with its adjusted earnings before interest and taxes (EBIT) increasing 15% YoY. Net sales in its “meals & beverages” and “snacks” segments both rose 15%. Additionally, the company raised its fiscal-year 2023 sales and earnings outlook.

The overall positive report sent $CPB shares higher by 6%. 🥫

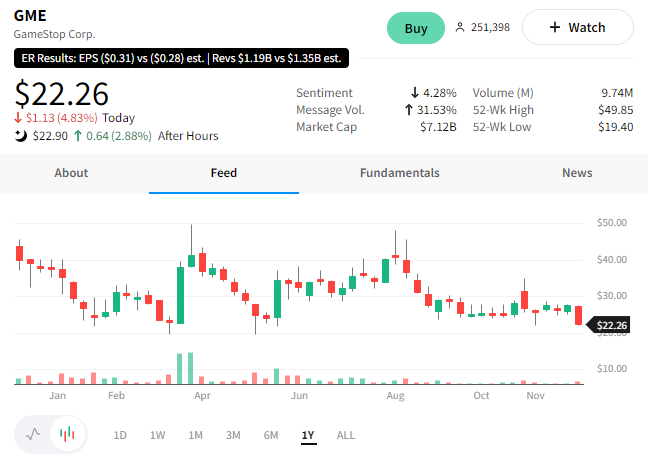

GameStop is erasing its regular session losses after reporting third-quarter results.

The brick-and-mortar retailer saw sales decline from $1.3 billion last year to $1.2 billion. Its net loss of $95 million was slightly less than the $105 million in the same period last year. 📉

Meanwhile, the company continues to burn through its cash, falling from $1.4 billion to $804 million YoY. With that said, it’s working to strengthen its balance sheet by cutting costs, which it hopes will prepare the company to make strategic acquisitions. It’s also struggling with a backlog of inventory, which sits at $1.13 billion.

Regarding the NFT marketplace it launched in July, the company said it continues to progress but did not break out those results for investors. It also said it’s making any of the customers affected by its partnership with FTX whole.

Overall, the company’s turnaround story remains in progress. With that said, $GME shares are hovering near their year-to-date lows as other meme stocks give up much of their gains. 😬