It was another day of records for the U.S. stock market as more and more stocks got snatched up in the bullish animal spirits. Let’s continue this week’s trend of pointing out the ragingly bullish action traders have been dealing with. 👇

Below is a chart of the S&P 500 showing prices rising for 16 of the last 18 months, posting a 25% rally since the end of October. It was also announced after the bell that Super Micro Computer and Deckers Outdoor will join the index, replacing Whirpool and Zions Bancorp. 📈

Meanwhile, the “Amazon of Africa” we highlighted over a month ago has rebounded sharply. The one-month chart of 30-minute candles shows how steep and orderly the rally has been, as heavily shorted stocks continue to be squeezed. 🛒

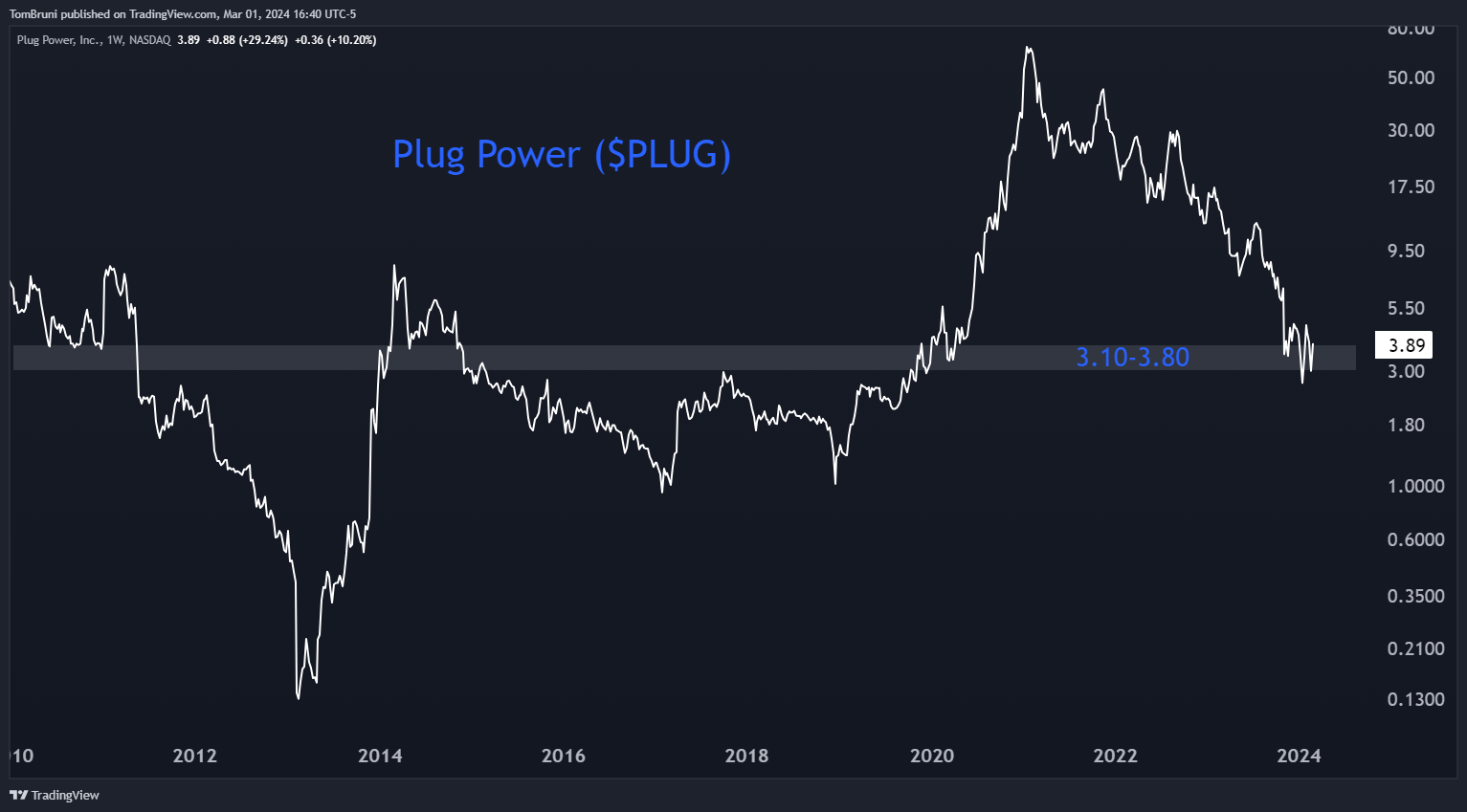

Speaking of heavily shorted stocks, Plug Power is trying to stabilize after saying its “going-concern” risk no longer exists. The hydrogen-technology company’s 2023 results missed analyst expectations, but its recent cost-cutting efforts and government grants have helped bolster its financial position. 💸

With the stock at a transition zone, investors and traders are watching closely to see if buyers can retake control. 👀

The message here is not specifically about trading Jumia or Plug; instead, it points out the recurring behavior we’re seeing in beaten-down stocks like them. Bears say these types of short squeezes signal the end of the bull run is near, as even the crappiest companies get snatched up. Bulls say it’s just the improving market breadth everyone’s been looking for and is a positive sign.

As always, the market will let us know who is right in due time. But for now, buyers are in control. 🤷