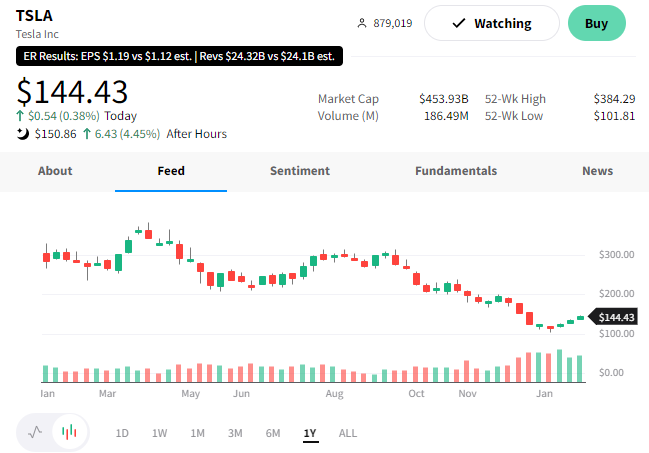

Today’s most highly-watched earnings report came from Tesla. But despite all the fanfare, shares didn’t move as much as anticipated. 🤷

Let’s see what the electric vehicle maker told investors.

Adjusted earnings per share of $1.19 beat the $1.13 expected. And revenues of $24.32 billion topped the $24.16 billion estimate.

Automotive revenue of $21.3 billion grew 33% YoY, with $467 million coming from regulatory credits. Margins contracted as expected, with automotive gross margins hitting their lowest level in five quarters at 25.9%. 🔻

Service and other revenue rose to $1.6 billion, and energy generation and storage revenue rose to $1.31 billion. However, rising costs in its energy business left little profit remaining.

Tesla did not issue new guidance but reiterated that it’s planning to grow production as quickly as possible to reach the 50% compound annual growth rate target set in early 2021. Additionally, it reiterated that the Cybertruck pickup is on track to begin production in Texas this year. 📝

Despite the beat, concerns around the demand for the company’s products remain. Some analysts argue that the price cuts signify waning demand and that its 50% growth rate target is unrealistic. The company took steps to quell some of those fears, acknowledging that average sales prices have been trending lower for years. However, it also noted that affordability is a necessary requirement if the company is to sell millions of cars per year.

Additionally, bulls argue that Tesla’s ability to focus only on electric vehicles gives it a meaningful edge over competitors who have to juggle internal combustion engine vehicles and their electric vehicle efforts. That means Tesla can accept a lower automotive margin and still be profitable.

Despite all the noise, the company continues to charge ahead. It plans to invest $3.6 billion to expand its Nevada Gigafactory complex with two new factories. One will mass produce its Semi truck, and the other will make 4680 battery cells. The company’s overall production capacity continues to expand. It can now make 100,000 Model S and X vehicles annually. And about 1.8 million Model Y and Model 3s vehicles. 🚗

$TSLA shares are up about 4% after hours. As always, we’ll have to see if this initial jump holds or if investors reach a different conclusion after reading the report more closely. 🕵️