Once companies discovered that membership and loyalty programs drove additional customer visits and spending, there became apps for everything. Trust me, I’ve got the McDonald’s app on my phone because I get free fries or something with my occasional purchase… 📱

Nonetheless, this shit clearly works, and everyone wants a part of it. Given Target’s recent struggle, it’s not surprising that it’s jumping on the bandwagon as part of its turnaround strategy.

Its new subscription-based program, Target Circle 360, will launch in early April and cost $99 annually. It’ll take on Amazon Price, Walmart+, and other competitor programs with unlimited free same-day delivery for orders over $35, free two-day shipping, and several other perks. 📦

The move comes after the big box retailer reported an annual sales decline for the first time since 2016 and expects sales to be flat to +2% in the year ahead. Target’s middle-class customer base has pulled back on discretionary goods, so Target has also focused on expanding its private-label necessities brands to help boost sales.

Cost-cutting helped get earnings back on track, so now the company will return to growing sales by focusing on customer value and convenience. Whether or not this membership program ever rises to the likes of Amazon or Walmart remains to be seen. But with the number of people we all know who live at Target, there’s surely going to be some takers. 🤪

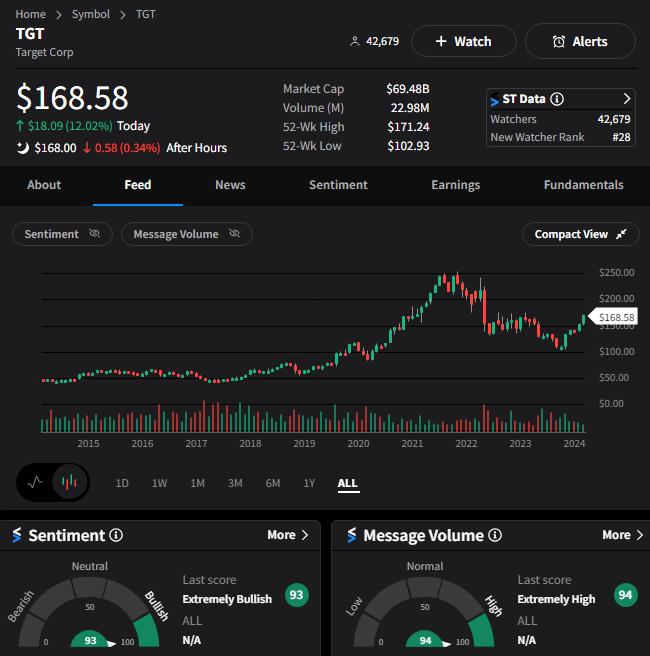

Overall, investors seem happy with the overall direction. Shares rose 12% to their highest level in 11 months, with Stocktwits sentiment pushing into “extremely bullish” territory. 🐂