It’s another day, which means investors and traders were buying anything in the semiconductor space that isn’t tied down. Let’s see what you missed. 👇

First up, chip-equipment company Applied Materials soared to new all-time highs after citing “artificial intelligence” momentum during its earnings call. Adjusted earnings per share and revenues both topped expectations, while its current-quarter expectations also beat estimates. 🏭

The thesis here seems pretty straightforward. If chipmakers are seeing massive demand, then the companies that supply those chipmakers with manufacturing equipment should also do quite well. And Applied Materials and its peers suggest they’re well-positioned to benefit from the current AI boom.

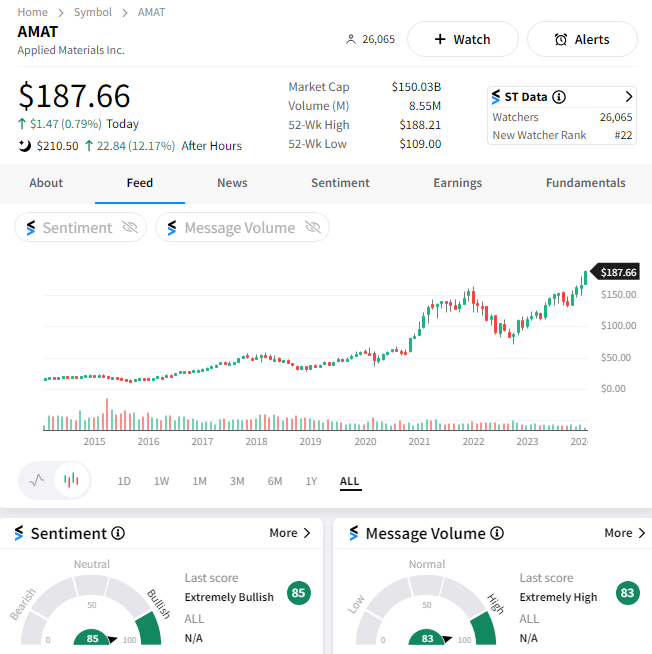

$AMAT shares surged 13% to new all-time highs, with Stocktwits sentiment and activity also jumping alongside it. 📈

Meanwhile, Nvidia added another milestone to its list, crossing Alphabet’s market cap to become the fourth largest company in the world. But according to CNBC, Nvidia isn’t the place to be. They’re looking at another stock that’s already up nearly 1,000% in the last year. 🫨

Of course, they’re talking about Super Micro Computer Inc., which also reached new heights by crossing the $1,000 per share mark. With prices more than tripling in the last month, we think it’s safe to say that animal spirits in the semiconductor space are reaching new levels…

How long it lasts is anyone’s guess. But if you’re going to continue playing, make sure to keep your open risk tolerable and plan for when the music slows (or stops). Because it always does. ⌛