With it being Nvidia day and all, let’s recap the semiconductor giant’s earnings and reaction. 👇

Before the print, we noted that Nvidia had only seen a downside surprise in earnings vs. expectations three times in the last ten years. However, with analyst estimates high and bullish sentiment roaring into the print, bears thought the contrarian view might have paid off.

Instead, we got more of the same action, with Nvidia delivering results that topped estimates. 🌠

Adjusted earnings per share of $5.16 on revenues of $22.10 billion topped the $4.64 and $20.62 billion anticipated. Its revenue guidance for the current quarter also beat, coming in at $24 billion vs. the $22.17 billion consensus forecast.

With Nvidia’s total revenue up 265% YoY, many investors are concerned the company may not be able to keep this pace of growth up forever. 😬

CEO Jensen Huang addressed those fears, saying, “Fundamentally, the conditions are excellent for continued growth in 2025 and beyond.” Demand for the company’s high-end chips will remain high due to generative AI reaching a “tipping point” and the industry shifting away from central processors to Nvidia’s accelerators.

On that note, data center revenues were up 409% YoY to $18.40 billion, with more than half of that from large cloud providers. Meanwhile, its gaming business rebounded, rising 56% YoY to $2.87 billion as the post-pandemic glut continues to clear in the market. ⛅

With tight supply and high demand keeping prices high and boosting margins, the company has the wind at its back in the current environment. When that will shift is unclear, but executives and investors alike don’t appear to be worried about that in the short to medium term. We’re all having too much fun to think about that…right? 😜

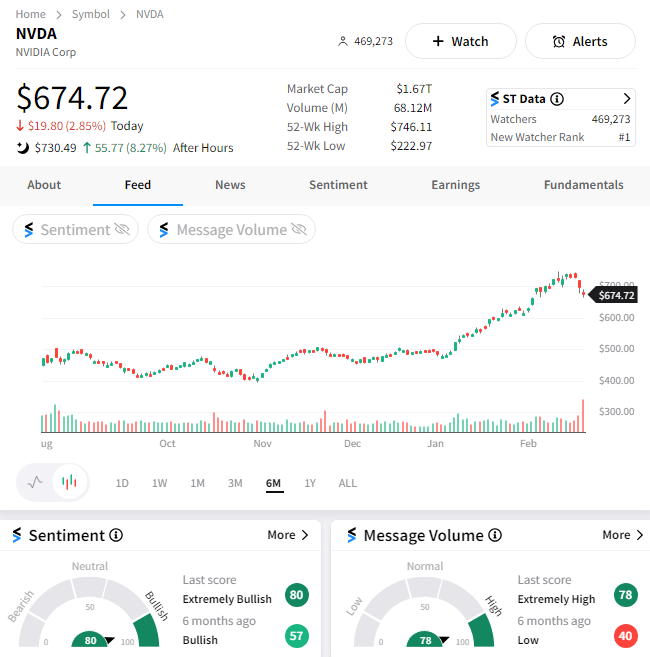

Given the options market implied a 10% move and shares are up 8% after the bell, option holders will likely feel some pain in the morning. However, the market remains optimistic overall, with the Stocktwits community sitting in “extremely bullish” territory as I write this. We’ll have to wait and see if bears take another shot tomorrow or if bulls use this momentum to push to new highs. 🤷