Earnings season is in full swing, which means a lot of reports to look through each day. This morning investors received some “sweet” news from three companies who delivered their results. 😊

First up was Roblox, which has struggled to deal with its post-pandemic growth slowdown over the last year. 😬

The company’s fourth-quarter loss per share of $0.48 beat the $0.52 expected. And revenue (bookings) of $899.4 million was up 17% YoY and exceeded the $881.4 million consensus estimate.

Its engagement numbers also impressed investors. The company reported 58.8 million average daily active users (+19% YoY) and said users spent more than 12.8 billion hours engaged in Roblox during the quarter (+18% YoY). However, its average bookings (revenue) per daily active user fell 2% YoY to $15.29. 🕹️

$RBLX shares were up roughly 26% on the positive news.

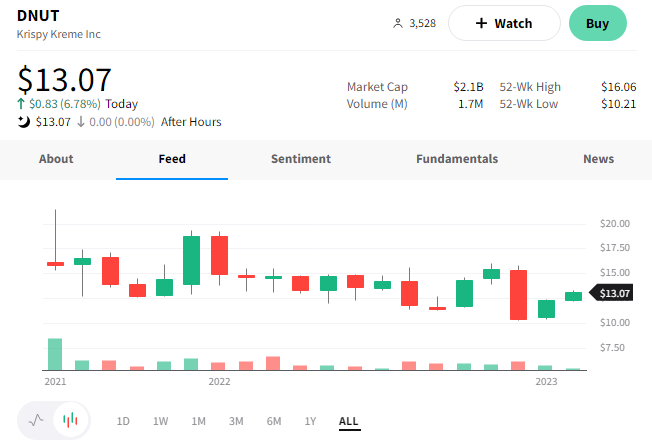

Next is Krispy Kreme, which inspired the title of this post. 🍩

The company reported adjusted earnings per share of $0.11, narrowly beating the $0.10 estimate. Its net loss per share was $0.02 but was driven by noncash charges associated with closing unprofitable restaurants.

Revenues were up nearly 10% YoY to $404.6 million, topping the $395 consensus estimate. It attributed part of its “scary good” results to the success of its Halloween and winter holiday specialty doughnuts. 🎃

Its e-commerce business also registered its best quarter since the pandemic’s start, growing 23% YoY. Helping drive that was expanding the company’s Insomnia Cookies chain delivery range to 10 miles. Executives believe that the brand “will be the next Krispy Kreme” and plan to expand into the U.K. and Canada this year.

Meanwhile, the Krispy Kreme brand continues to make its global push, expanding into five to seven new countries this year. That’ll bring it to thirty-five countries worldwide. 🗺️

Executives’ upbeat outlook included adjusted earnings per share of $0.31 to $0.34 and revenues of $1.65 billion to $1.68 billion in 2023. This forecast was mainly in line with consensus estimates.

$DNUT shares were up roughly 7% on the day but have remained in the middle of a wide trading range since coming public. 🤷

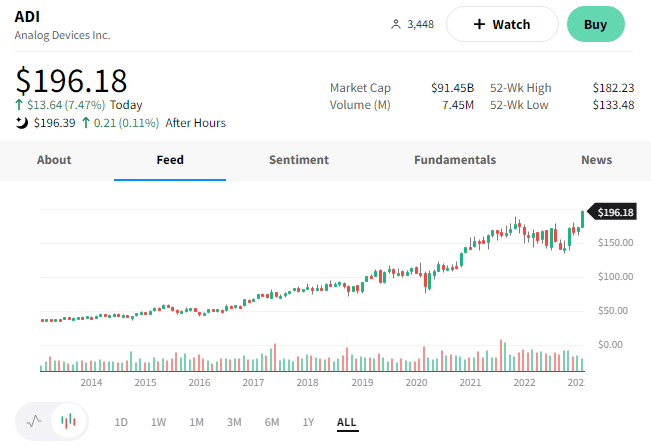

And last but not least is Analog Devices, whose shares hit a new all-time high after it reported results. 🤩

The chipmaker reported stronger-than-expected fiscal first-quarter earnings. Its adjusted earnings per share of $2.75 and $3.25 billion in revenue beat the consensus estimate of $2.61 per share and $3.15 billion, respectively.

Executives cited record automotive and industrial chip sales as the reason it handily beat expectations. In addition, its CEO, Vincent Roche, pointed to several secular trends, including AI, as tailwinds for the company and industry. He says the company is “…the bridge between the physical and digital worlds, is well-positioned to deliver breakthrough innovations that positively impact society and unlock long-term value for all stakeholders.” 🤖

Semiconductor stocks had a rough run since peaking in late 2021 but have recovered strongly since October. $ADI shares flexed their strength today, rising 7% to a new all-time high on the news.