Video game software developer Unity probably wishes it could reload its last saved checkpoint after reporting another quarter of lackluster earnings. 👾

Although revenues of $609 million topped expectations of $451 million, management noted revenue would have been $510 million if its deferred revenues were not released. Meanwhile, the company’s net loss of $0.66 was narrower than last year’s $0.82 but still much higher than analysts’ $0.46 per share expectation. 🔺

Management told investors it’s in the middle of a “two-phase company reset that we expect will enable Unity to sustainably win with customers and shareholders.” The portfolio and cost structure part is mostly completed, so the company is shifting back to driving revenue growth.

With that said, it will take time for its efforts to pay off, with the company forecasting just $415 to $420 million in first-quarter revenues. Analysts had anticipated $534 million in revenue and were also thrown off by the company, saying its non-strategic business portfolio would no longer be a meaningful source of revenue. 👎

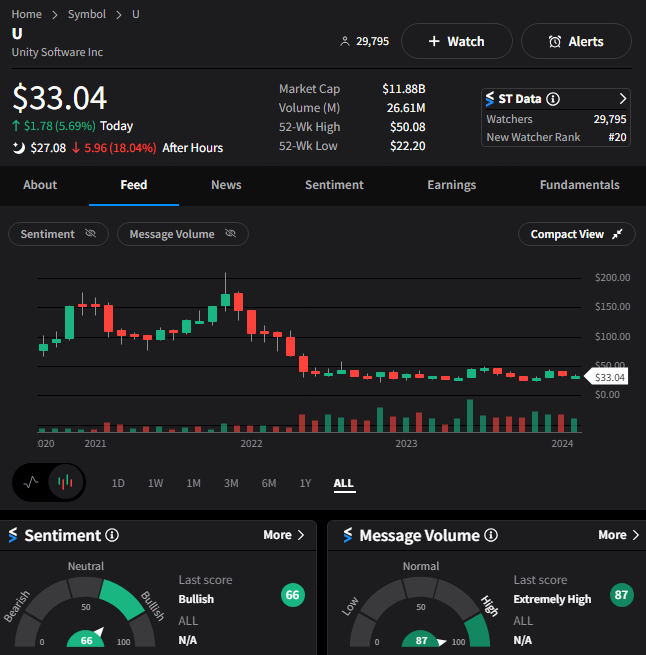

Overall, Unity’s projections and tone failed to restore confidence with shareholders. $U shares are currently down 18% after hours, though interestingly, our sentiment data suggests Stocktwits users turned more bullish on the company today. We’ll have to wait and see if they’re right. 🤷